LIBOR is Dead — Long Live LIBOR!

A week ago, we read an interesting piece in Bloomberg: “LIBOR Refuses To Die, Setting Up $370 Trillion Benchmark Battle.” Readers may be familiar with the LIBOR — the “London Interbank Offered Rate.” If you bear with the discussion that follows, we’ll explain why this matters for your investments.

LIBOR is perhaps the most important benchmark interest rate in the world, with more some $370 trillion worth of assets tied to it. About six years ago, it was discovered that the rate was being manipulated by employees of many globally significant financial institutions. The scandal resulted in billions of dollars’ worth of fines being levied against Barclays, UBS, Rabobank, Deutsche Bank, and others. The administration of the benchmark was transferred from the British Bankers’ Association, and it is now administered by Intercontinental Exchange [NYSE: ICE].

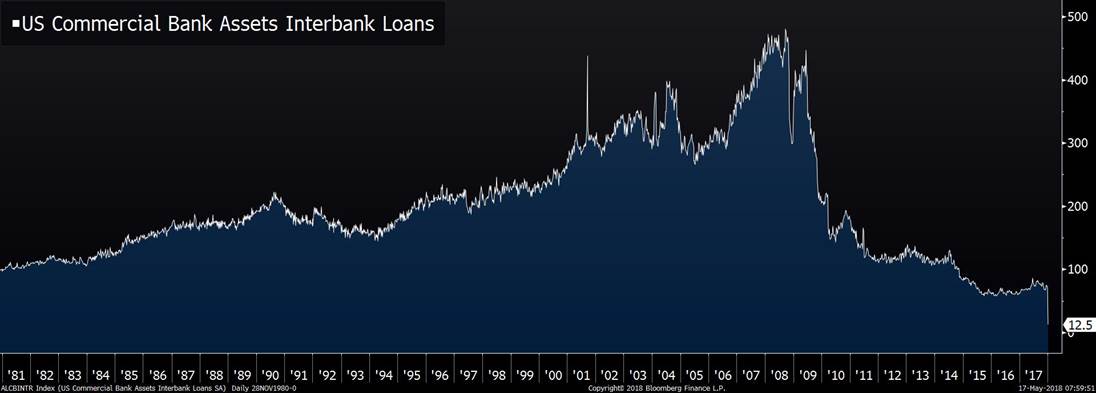

Many regulators have not liked LIBOR and would like it to go away. In its pre-scandal form, LIBOR was a measure of “inter-bank” rates, that is, the rates that banks participating in the benchmark would expect to charge one another for short-term lending. The trouble was that such lending had sharply declined in the years following the financial crisis, as new financial regulations came into force. So the quoted rates that went into the calculation were based on less and less real, reliable, verifiable data — which was what opened a window for traders to collude and game the rate to boost their gains.

In the Post-Crisis Period, Interbank Lending Evaporated Due To Increased Regulations

Source: Bloomberg

Now that LIBOR is being administered by ICE, the benchmark rate’s new managers have made reforms to the way in which participating banks derive and submit the rate quotes that are its basis.

Regulators would like there to be a LIBOR alternative. In 2014, the U.S. Federal Reserve began working on an alternative called SOFR, the “Secured Overnight Financing Rate,” which was recently rolled out (with a few hiccups).

The Bloomberg article mentioned above was interesting because it pointed out that in spite of regulators’ dislike of LIBOR, there continues to be a market for it — that is, financial institutions want there to be a LIBOR quote on which to base their products.

Indeed, LIBOR (in its new incarnation as administered more transparently by ICE) is getting more popular, not less. Why would this be so, if it is based on an increasingly scanty data pool? The reason is essentially that the LIBOR competitors such as SOFR will more closely reflect the Fed funds rate in a crisis — that is, in a time of financial stress, LIBOR will likely rise, while SOFR and other similar benchmarks will fall as central banks lower interest rates to stem the crisis. The continued existence of floating-rate debt instruments based on LIBOR also affords more opportunity and flexibility to major players in the financial system to structure debt offerings in ways that will benefit them under a variety of future scenarios.

Therefore, there will continue to be demand for floating-rate debt based on LIBOR, and what there is demand for, there will be supply for. Financial conditions currently remain stress-free, and there are no imminent problems. But we have noted several ways in which the first signs of excess are beginning to become visible — for example, the expansion of leveraged corporate debt funds being used by pensions to satisfy otherwise unattainable needs for returns to meet their actuarial assumptions. The continued preference of many financial actors for LIBOR-based products is another manifestation, and it reflects the ways in which post-crisis regulation has in fact served to encourage activities still more opaque than the ones it set out to suppress.

Investment implications: We do not believe the next crisis is imminent, and still foresee a significant period of strong economic growth, healthy financial markets, and good stock returns. However, we see early signs of financial excess, for example, in leveraged debt markets. The apparently ineradicable popularity of LIBOR as a benchmark also helps makes complex, opaque, and leveraged financing more flexible and available. It is early, but important enough for investors to be aware of as a barometer for any coming storms.