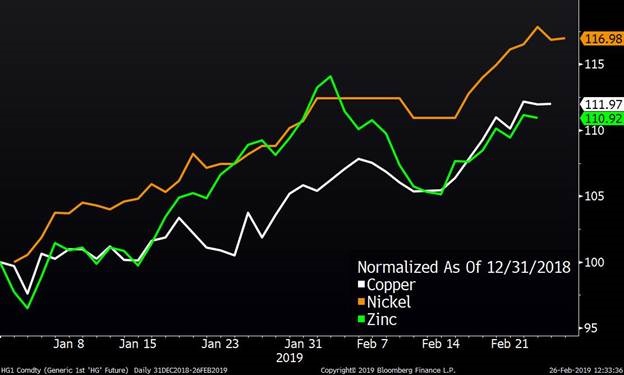

Several base metals have rallied strongly in 2019: as of this writing, copper, nickel, and zinc are all up more than 10%. Copper — the “red metal” — is often referred to as “Dr Copper” because of its alleged status as a leading economic indicator. It is the leading industrial metal, a critical commodity across construction, manufacturing, and technology.

Source: Bloomberg, LLP

What is driving the rally?

First, inventories are low. Inventories of several metals stored on global exchanges are down 25% from levels seen at the beginning of 2018; 2019 is expected to see a supply/demand deficit for copper.

Second, investor sentiment about the strength of the global economy is improving.

For two decades, China has been the world’s most voracious consumer of base metals to fuel its industrialization and urbanization. As we’ve written before, in recent years it has moved back and forth between policies to support growth, and policies to reduce overleverage in its financial system.

Last year, it began to shift back towards stimulus, and has been gradually implementing policies to stimulate credit growth, support lending to small and medium-sized businesses, and now to reduce some constraints on capital markets and bolster the role they play in the domestic economy.

President Trump’s Sunday extension of the trade-deal deadline also increased optimism that a U.S./China deal was in the offing.

Some macroeconomic analysts are beginning to believe that the deceleration in global growth that contributed to fourth-quarter stock market declines is approaching or has passed its bottom, and that reacceleration is likely into the second half of the year. This has been our view of the likely course of events in China for many months.

Since stock markets are discounting mechanisms, we believe that the strong performance of several global stock markets is pricing in this reacceleration. In the case of China and of the U.S., markets may be pricing in optimism about both economics and policy. The U.S. market seems to be relieved that the Federal Reserve has more clearly communicated its cautious and policy-driven stance; and the Chinese market is exuberant at the prospect of official support for stocks, rather than the restriction and regulation that came in the wake of China’s 2015 stock-market crash.

This turn in China is of particular importance for copper.

Sentiment about the strength of the world’s largest economies turning positive suggests that copper in particular has a lot of room to run. Copper is highly leveraged to sentiment about the global economy, and even after its year-to-date rally is not far above long-term cost support. Many copper mining equities are still down significantly from their highs near the beginning of 2018:

Source: Bloomberg, LLP

With all of these converging factors, we are bullish on copper in 2019.

Investment implications: We are bullish on copper and some copper-mining equities. Investors can find exchange-traded funds for exposure to copper as a commodity and to shares of copper-mining companies. Note that copper is an extremely volatile commodity; be aware that it will be subject to price volatility, so it is not suitable as a major part of your portfolio. It is a trading vehicle, not an investment instrument.