In 2015, the U.S. removed a restriction that had been in place since the 1973 Arab oil embargo — one that had prohibited crude oil exports. The result could be described, as we quote from in our headline from the head of the International Energy Agency, as a “second wave” of the shale revolution.

Source: International Energy Agency

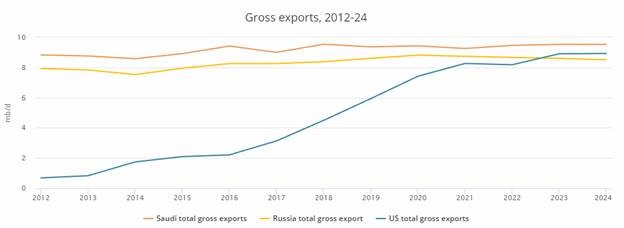

U.S. exports are now growing at a pace that will see them unseat Russia as the world’s second-largest exporter — and come close to dethroning Saudi Arabia for the number one spot. U.S. exports, running at 3 million barrels a day for the past four weeks, already exceed Kuwait’s pace. By the end of the year, U.S. exports will surpass the all-time high they set back in 1970.

There will be wide-ranging geopolitical consequences; as readers are well aware, oil is a commodity of unparalleled geopolitical significance. U.S. production will lend muscle to U.S. foreign affairs — indeed, it may already have contributed to a more robust response to the Venezuelan conflict and support for opposition leader Juan Guaidó, as well as a more trenchant response to Iran’s nuclear ambitions.

There are still difficulties to iron out. The rapid growth of the U.S. export industry means that physical infrastructure and contractual relationships are straining to keep up. But those are problems that will certainly be solved in relatively short order as ports are expanded and regular buyers for light American crude emerge in Canada, Italy, the UK, South Korea, and elsewhere.

Investment implications: Growing U.S. exports will continue to shift the landscape of global oil markets and petroleum geopolitics. The fact that the U.S. is now satisfying so much of its oil demand domestically, as well as growing its exports at such a dramatic and unprecedented pace, suggests pressure on the price of oil. Shifting global attitudes towards hydrocarbon production, exemplified by the Norwegian sovereign wealth fund’s recent announcement of plans to divest hydrocarbon-related assets, lead us to see additional pressure for oil companies. What’s good for the U.S. economy may not be good news for energy investors, although for income-focused investors, some energy equities may still be attractive.