The U.S.

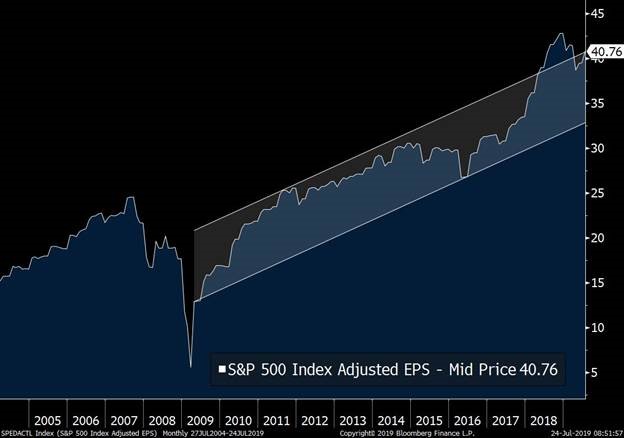

Earnings season in the U.S. is in full swing. While earnings growth has stalled after the tax-break driven pace of growth that was enjoyed in 2018, it remains broadly within the trend of growth that has followed the 2008/2009 financial crisis.

Source: Bloomberg, LLP

Of course, there are many factors at work here besides taxes — cross-currents of everything from deregulation, to business confidence, to geopolitical tensions and trade issues. Still, we suspect that the underlying earnings growth trend has inflected from a lower base.

As we have written for many months, we remain fundamentally bullish on prospects for the U.S., although global economic growth is decelerating. One of our favorite strategists, Tony Dwyer of Canaccord Genuity, often reminds us of the wisdom he imbibed from his mentor: “Don’t fight the Fed and don’t fight the tape.” The Fed is likely to ease at the end of this month; and to us, the tape reads that although a near-term correction is warranted, the market still wants to rise. We do not know what the excuse will be for the next correction, but with all the pillars of the rally still in place — accommodative monetary policy, good economic growth, positive business and consumer sentiment, rising earnings, and healthy overall credit conditions — we believe that correction should be bought.

We would use the opportunity to buy our “usual suspects” — primarily big growth companies front and center in the new digital industrial revolution: artificial intelligence, data analytics, the cloud, cybersecurity, networking, defense electronics, and financial technology. Investors should monitor big tech regulatory risks, but we do not believe that these risks are imminent. For our dividend-focused clients, we might use the opportunity to add to holdings of companies with substantial and sustainable dividends and strong track records of dividend growth.

Beyond the U.S.: Europe and Emerging Markets

The U.S. is still where we see the best opportunities. Some long-term opportunities are present in emerging markets, particularly in India, but while global growth fears and trade war uncertainty are still at work, we would be patient before taking significant positions. Europe continues to be fundamentally unattractive.

Gold, Silver, and Cryptocurrencies

For all the reasons mentioned in our lead piece this week, we believe that the time has come for investors to revisit their portfolio allocations to precious metals and precious metal mining shares. We are bullish on gold and silver.

Bitcoin continues its consolidation. As gold continues to rise, it will be interesting to see if bitcoin fulfills any of its hype as a form of “digital gold,” and if it proves to have any of the characteristics that lead perceptive investors to favor gold as a defense against monetary debasement. There is potential — but we also feel that digital assets have not yet felt the full force of a government determined to rein them in. When that happens, markets may quickly reassess bitcoin’s attractiveness compared to its ancient golden rival.

Thanks for listening; we welcome your calls and questions.