The U.S.

The U.S. market got a modest boost from the announcement of a trade truce with China, in which China agreed to boost some U.S. agricultural imports, and the U.S. suspended a tariff hike on $250 billion worth of Chinese imports. According to the announcement, the initial deal will be hammered out over the next four to five weeks, and be followed by work on a more comprehensive “Phase Two” agreement covering thornier issues such as intellectual property. So far, the U.S. has not backed down from its threatened December 15 levy on most of what remains of China’s exports to the U.S. that haven’t yet been hit.

This is more or less the script we have been anticipating: progress on the easier items that permits both sides to present negotiations as a win to their home audience, and a delay of the grittier and more troublesome items. Those might well be under discussion for many months to come. However, as we have observed many times, both sides have reasons to compromise. In an election year, the U.S. administration needs a trade win that can benefit voters; and China is facing domestic economic and political challenges that also make a deal desirable. Senator Elizabeth Warren’s rise to front-runner status in the Democratic nomination race may make the Chinese think twice about any attempt to “wait out” the Trump administration and hope for a more pliant successor — Warren’s public China policies are, if anything, tougher than Trump’s.

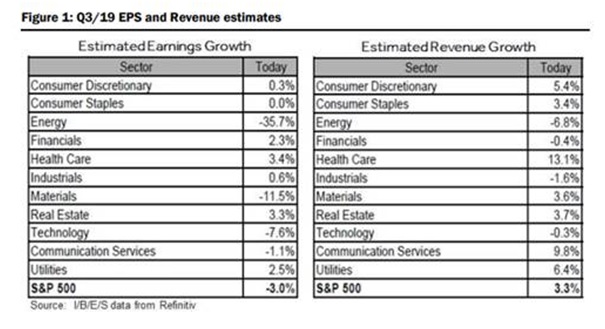

Earnings season is underway, and as we anticipated last week, companies are mostly beating estimates. Reported earnings are expected to be slightly up in aggregate; revenues so far are up about 3.3%.

Source: Canaccord Genuity

Investors should remember that year-on-year earnings growth is still up against the tough comparisons from the tax-cut boost that occurred in 2018. When that is lapped after 2019’s final results, more robust EPS growth should resume.

The UK and Europe

Brexit negotiations are coming down to the wire, with a deal appearing more possible albeit still very uncertain. Looking beyond the outcome, we remain long-term positive on economic prospects for the UK outside the EU. Investors are bidding up the British pound, and we believe that the British stock market may be a good buy with both a strong pound and the prospect of a unilateral trade agreement with the U.S. We think the UK will do very well once it is free of the EU, and we note that construction is booming in London. Count us as longer-term bulls on the UK stock market and on the pound. Obviously major real estate investors see London as a desirable destination.

Immediately after the Brexit date of October 31, incoming EU Commission President Ursula von der Leyen takes the reins. We’ll comment about prospects for her presidency next week, but she has announced a push for more concerted growth-oriented fiscal measures in Europe’s response to the UK’s departure and Europe’s economic slowdown. Constructive European action — even if the fiscal stimulus occurs in economically questionable projects focused on the environment — could result in a tactical opportunity in Europe. Still, we are not long-term enthusiasts for European stocks or the euro.

Gold

As the third slowdown of the post-crisis expansion bottoms and turns, rising optimism will lead to less momentum for gold. We still see medium and longer-term positives for gold. Although we believe that the bull market in stocks has further to run, both individuals and institutions are hedging the possibility of future volatility that may eventually ensue from the unwinding of many of the post-crisis period’s unconventional monetary policies. Those with a longer view of the cycle will still be well-served by monitoring these longer-term trends and evaluating their holdings of gold accordingly. Central banks are still buying, as they are well aware that monetary policy globally will be loose for the foreseeable future.

Bitcoin Implicated In Huge International Child-Abuse Bust

U.S. and Korean authorities announced the existence of a massive law-enforcement operation targeting a child pornography website being operated out of Korea. Although the site was taken down in March 2018, law enforcement did not publicize the operation until now, so that they could continue to conduct a covert investigation which has resulted in hundreds of arrests in almost 40 countries (including two dozen U.S. states). The operation resulted in the rescue of two dozen children being actively abused by the criminals.

We are deeply grateful to U.S. and international law enforcement for using all tools at their disposal to fight this evil, which has proliferated in the darker corners of the internet thanks to encryption technologies and, unfortunately, cryptocurrencies. The news should be of concern to crypto speculators.

Unfortunately, many cryptocurrency transactions are not legitimate economic exchanges, but are conducted to avoid law enforcement scrutiny of criminal activity. Criminals often believe that transacting in bitcoin would cloak their identity. As we have pointed out many times since we began covering cryptos, this belief is incorrect. Intelligence and law enforcement agencies have the wherewithal to triangulate external data with transactions recorded on the blockchain to unmask the real-world identity of crypto transaction participants. That was how law enforcement caught the 338 child abusers in this case.

A representative of the IRS’ Criminal Investigation Division commented: “Our agency’s ability to analyze the blockchain and de-anonymize Bitcoin transactions allowed for the identification of hundreds of predators around the world.”

Given that bitcoin’s major use-cases are often still in legal gray areas — or, as in this case, much worse areas than that — the public perception of the vulnerability of the bitcoin blockchain to this kind of analysis will be a headwind for its price.

Thanks for listening; we welcome your calls and questions.