Last September, after the crisis in the overnight repo markets, we wrote:

“The recent funding stresses that drove U.S. overnight repo rates to spike point out actions that the U.S. Federal Reserve will need to take over the coming year to ensure liquidity. Accounting for organic growth in liquidity needs, the need to re-establish a larger liquidity buffer, and the rollover of maturing mortgage-backed securities into Treasuries, all imply that over the next year, the Fed will need to purchase a significant quantity of Treasury paper, perhaps $500–$600 billion.”

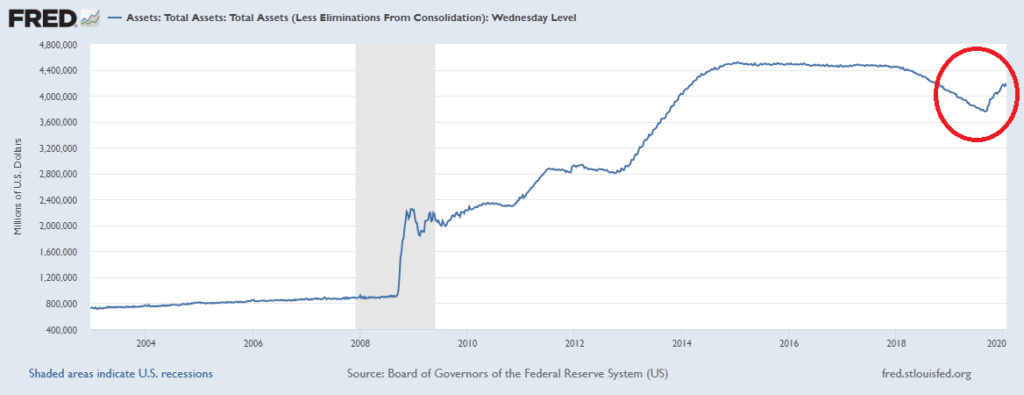

Don’t say we didn’t tell you. As we anticipated, between September of last year and mid-January of this year, the Fed’s “not QE” program of Treasury purchases and repos expanded its balance sheet by approximately $400 billion. It has since ticked down slightly as some longer-term repos have rolled off.

The Fed’s thorough pivot last year — from Chairman Powell’s reversal of the balance-sheet reduction “autopilot” early in the year, to the liquidity tsunami of “not QE” in the year’s final quarter — helped propel U.S. markets to new highs. In a period of stagnant earnings growth, most of the appreciation in stocks was due to buybacks and multiple expansion. Those were driven by abundant liquidity and congenial financial conditions.

Although the Fed has carefully insisted on the “not QE” nature of its present trajectory, and although its balance-sheet (re-) expansion may not continue at the same pace as it had for the past quarter, the Fed’s intention to remain highly supportive of markets is clear.

Investment implications: It is an election year, and therefore the Fed will be even more wary than usual of any policy shifts that could be interpreted as partisan. There are also numerous potential “black swan” events ready to spook markets, as the Fed is well aware. We think it is highly likely that investors can count on the Fed’s policy consistency for the rest of 2020.