Part of the emerging narrative about the long-term economic effects of the COVID-19 pandemic and the business closures ordered in response to it suggests that it will lead to the ascendancy of the Big. The reasoning goes that big companies will be able to survive the downturn and will eat the lunch of smaller players as they fold up shop; big companies are well-connected and will be able to take better advantage of the support coming from governments. COVID-19 will be like weed killer sprayed over the economy, killing all the little plants and just leaving the big ones standing.

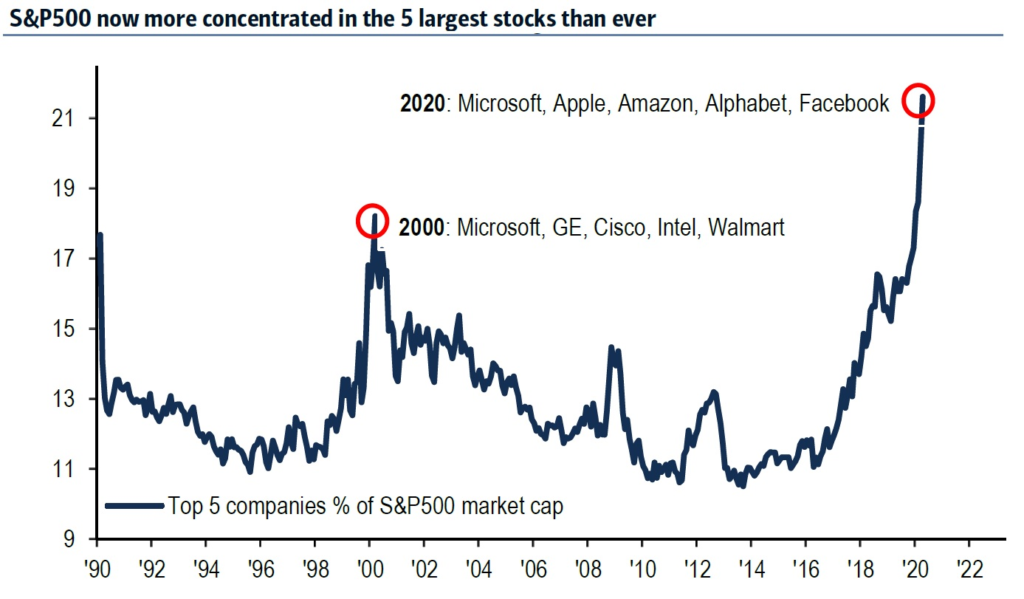

The narrow breadth of the current stock market rally seems to offer some corroboration for this view. Gains have been highly concentrated in the top few stocks, so that the five largest firms in the S&P 500 now comprise a greater part of that index’ total capitalization than the top five did during the Dot Com bubble. (Still, these five powerful companies are very highly connected with the internet, e-commerce, online business activity, and communications, and therefore are beneficiaries not only of the pandemic but also of many oncoming changes in the way the world operates.)

This view of the pandemic’s effects is a little one-sided. In some areas, the pandemic may indeed have the effect of privileging big businesses over small. However, in other areas the reverse may be true. Often, large businesses are less agile and adaptive than their small competitors, and that can allow those competitors to gain traction at their bigger rivals’ expense.

This is after all why small businesses are the best drivers of both innovation and job creation in economies around the world. It is also why firms tend to show the most robust growth early on, and then slow as their internal culture becomes more established and bureaucratic, and as they move towards saturating their addressable markets. It’s an extraordinary company that can get big and remain a powerhouse of innovation and entrepreneurial vitality.

One clear location where we see that COVID-19 is creating advantages for smaller businesses is in the rollout of the Paycheck Protection Program (PPP) of the CARES Act. This provision set up a loan facility for small businesses to help them bridge the period of social distancing, make payroll and meet other fixed expenses.

You would expect that the big banks would dominate this process — after all, they have the best digital tools for handling the crush of applications, for reaching out to their customers, and so on. But in the first round of the PPP, that wasn’t what happened. The big lenders suffered operational delays and many small businesses found that they couldn’t secure loans through their established relationships with big banks. Instead, they turned to regional and community banks. In many cases, those regional and community banks reached out to local small firms to solicit their business and then successfully shepherded them through the loan application process. They often did not have the electronic infrastructure, but they quickly put most of their staff to work in loan processing.

Some community banks have actually grown their loan books so much in the process that they have had to coordinate with peers in other states to distribute some of the loans so that they don’t reach the $3 billion threshold that would require more regulatory oversight and drastically raise their compliance costs. Notably, the small firms who benefitted from community banks’ adaptability often express their intention to shift their business permanently to their lenders when the crisis is over. Thus, this is a clear case where the adaptability and agility of small businesses such as community banks is more successful in a crisis than all the “resources” of their larger competitors.

Investment implications: The dynamic of smaller banks beating their bigger rivals for business in the wake of COVID-19 may play out in other areas too. The pandemic will result in a lot of unexpected changes that might not fit the common narrative, and may benefit businesses beyond what the headlines would suggest.