Trump’s Legacy

It could charitably be said that the outgoing U.S. administration was characterized by non traditional trade strategies. But we can say that in spite of the polarization and vituperative rhetoric on both sides, the outgoing administration believed that it was in fact simply responding to longstanding economic and geopolitical trends with many of its trade measures, especially in its dealings with China.

We suspect that in regard to trade with China, there will in fact be substantial continuity between the Trump and Biden administrations. The real world will require it.

China: A Problem That’s Not Going Away

We’ll write more about this subject in coming weeks. Suffice it to say here that China’s ambitions as a would-be global power — playing a “great game” of global economics, domestic control, and international diplomatic skullduggery — will almost inexorably call for further resistance from the U.S. and its allies. That wasn’t just a Trump affair; it was and is an historical reality much bigger than Trump’s presidency.

Today, our interest is in one large consequence of that emergent geopolitical conflict — the boosting of manufacturing economies beyond China, and particularly, the enormous opportunity that this major global realignment presents for India.

India

There are many reasons to be bullish on India as we head into 2021. The overwhelming consensus of analysts is that the outlook for 2021 will be shaped by a few extremely powerful forces: control of the pandemic, a sharp rebound in economic activity, plentiful liquidity in the global financial system, and robust fiscal support from most world governments.

(These policy measures will likely have negative future consequences in the form of inflation, indebtedness, and challenged growth prospects, but we don’t believe those outcomes are imminent. Likewise, there are nearer-term risks to the Goldilocks consensus, especially, in our view, surrounding the belief that the multitude of covid vaccines will prove as safe and effective in reality as has been claimed on the basis of truncated and rushed testing regimes. These are risks we will have to evaluate in real time as the new year unfolds.)

For now, though, India is well-positioned to benefit from all the near-term forces driving global reflation in 2021. It was hard-hit by the virus, and successful vaccine rollouts will allow a more powerful growth snapback in India, especially in its service sectors and consumer-facing industries. 2021 GDP growth could be in the region of 13%, with relatively quiescent inflation as pandemic recovery reduces food price spikes. All in all, Indian equities may exhibit greater sensitivity to the post-pandemic recovery than those of many emerging economies, and the rupee is expected to experience modest appreciation against the U.S. dollar in the coming year.

But our real interest in India is longer-term. India has been undergoing deep reforms under Prime Minister Narendra Modi since 2014. India, in spite of its educated and entrepreneurial population, and its enthusiastic acceptance of pluralistic, representative democracy, had long been hampered by a sclerotic socialist tradition that had originated among the cultured agitators who led its independence movement. Overcoming that inertia and unleashing India’s potential was never going to be an easy process.

Six years of Modi’s reforms, meeting the twin pressures of a global trade realignment and a global pandemic, may finally be bringing India to an inflection point.’

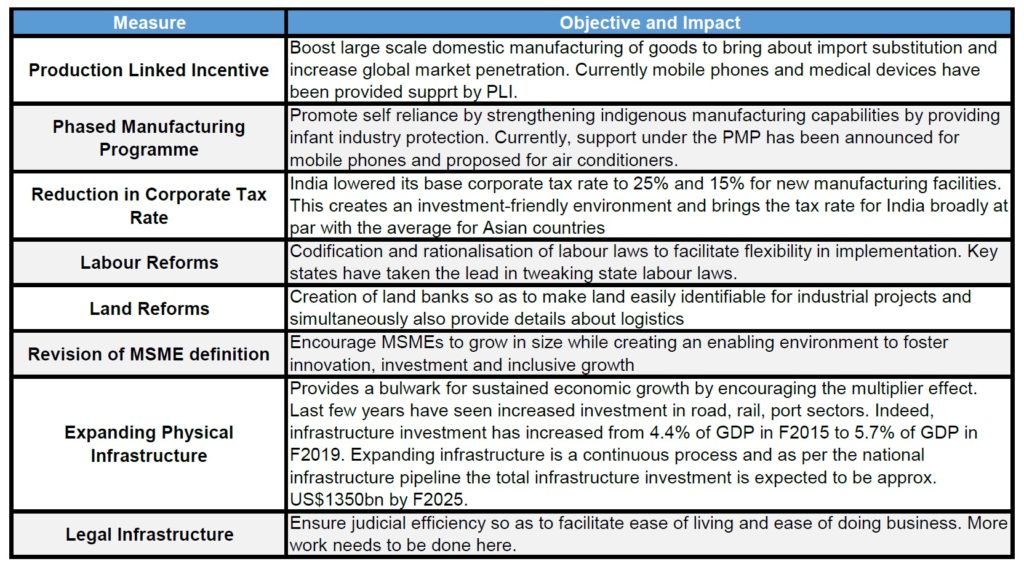

Although India has a burgeoning and creative consumer-facing digital economy, which we have often noted in these pages, the real bread and butter of Indian growth over the next decade will come from the expansion of manufacturing, the tried-and-true recipe for developing countries advancing to middle-income status. (No country has made this shift without reliance on manufacturing exports.) Many of India’s reforms are focused, directly or indirectly, on encouraging manufacturing growth. Here is a summary:

All have made significant headway under Prime Minister Modi. Measures are focused on industries set to benefit from China’s trade tensions and the diversification of global supply chains, including electronics (especially mobile phones and mobile components), capital goods (such as power equipment), medical devices, military equipment, white goods, solar power generation equipment, and chemicals. Some of the incentives are protectionist measures intended to reduce India’s reliance on Chinese manufacturers for these items and thus spur domestic competitors — enabled by the broader structural reforms listed above.

If reform measures continue, if legal and physical infrastructure improvements continue, and if, critically, India’s domestic banks continue to become less risk averse in their lending, these measures may set the stage for substantial growth in Indian manufacturing over the coming decade. That, in turn, as India makes progress towards middle-income status, will provide a powerful stimulus for domestic consumer-facing companies riding the wave of digitization, as we have discussed in recent weeks.

In essence, for India’s real potential to manifest, we need to see global growth, continued political stability within India, and continued momentum in reforms. Right now we see all of these factors in place, with additional tailwinds provided by geopolitics and the pandemic policy response.

Investment implications: We see both near-term and longer-term structural reasons for bullishness on the Indian economy. U.S. based investors have relatively few ways to get exposure to Indian stocks, but more ETFs are becoming available, some focused on particular sectors and themes. We believe that an overweight allocation to India among emerging markets has a significant probability of outperformance over the next decade, if the country continues on the reform path charted by its current government. The apparently inevitable collision of Chinese global ambitions with the liberal democratic global order is likely to lead to continued trade realignments that will give Indian manufacturing a strong tailwind.