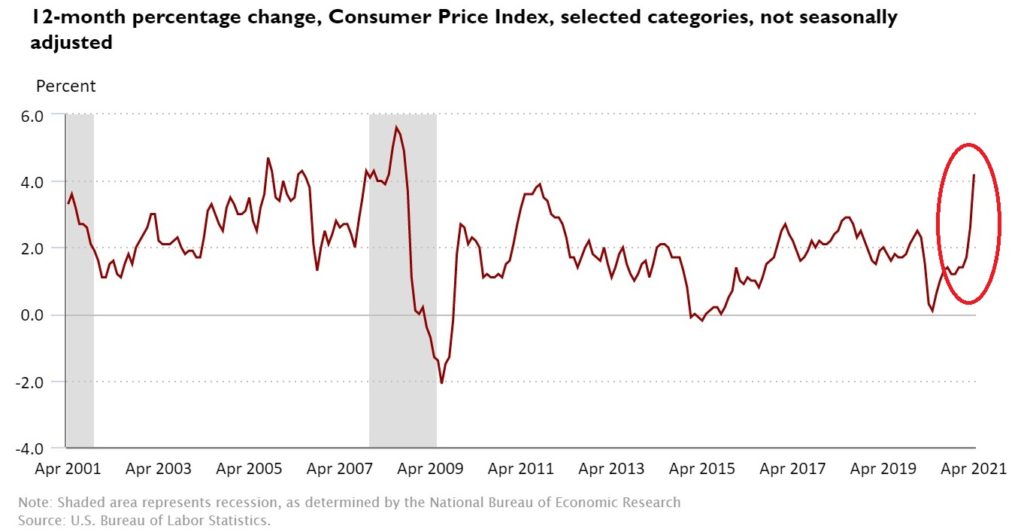

April inflation data came in hot, as we’ve been predicting for months. By bringing you our Guild Basic Needs Index, we have been preparing you for some of the eye-popping numbers you will see. Year-over-year, lapping last year’s first full month of pandemic lockdowns, prices rose 4.2%. But month-over-month, overall consumer prices rose 0.8%, after March’s 0.6% rise and February’s 0.4%. We call that “acceleration.”

We’ve been noting for some time that an inflationary shift is underway. As important as the objective shift itself is the psychological shift that accompanies it — really, which preceded it. The acceleration of the month-over-month reading is likely to shift public psychology still more in an inflationary direction. What behaviors it will spur, is the question; will it be taken with aplomb, or will it lead to shortages and hoarding?

To be clear, we don’t believe that the inflation which is coming is going to rival the inflation of the 1970s in magnitude. What we are likely to see, we believe, is inflation substantially higher than market participants have seen in the post-2008 period, and yet lower than the inflation driven by the fiscal and monetary policies of the 1960s and 1970s.

We’ll outline the basic forces working for and against inflation below. These are important to note, because a strategy to defend your investment portfolio against inflation will involve exposure to different sectors and themes in different phases of the inflation process. Remember that inflation itself is not an on-off switch; like everything else, it is a cycle, with different prevalent characteristics at different phases of that cycle.

Pro-Inflationary Forces

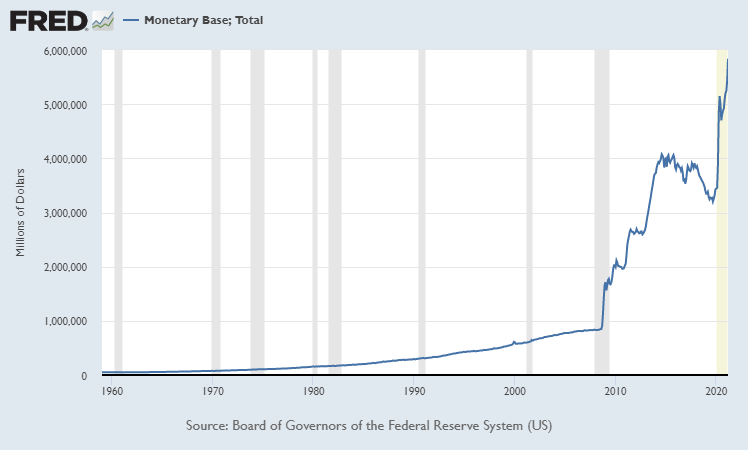

Milton Friedman’s dictum was that inflation is “always and everywhere a monetary phenomenon.” Like most economic truisms it’s not completely true, but it’s certainly helpful. The post-pandemic expansion of the money supply has been a supernova eclipsing anything ever seen, although from another perspective, it is merely another chapter of the story that began in 2008. The chart below is one you have probably seen many times, but it bears repeating to emphasize the extraordinary nature of current events:

Many prominent investors have agreed with us in pointing out the inflationary impulse, and those who are younger are admitting that the current policy environment is unlike anything seen in their careers. The U.S. Federal Reserve and the U.S. Treasury, acting in coordination, have been the leaders of this global monetary blitzkrieg, but the developed world’s other central banks have also been on the project, to varying degrees. Only a few countries — Russia, Canada, Brazil — have shown moderation.

The second contributor to the accelerating inflationary impulse is supply-chain disruption. It’s visible everywhere in various forms, from raw materials and energy to transportation and logistics and therefore in the finished goods that embody these costs. The “efficiency” of modern just-in-time inventory and delivery systems was revealed by the pandemic to have a dark side of fragility, and the sudden stop and start of the system is proving to have chaotic and unpredictable consequences. The shortage of semiconductors and the astronomical spike in lumber prices are just the tip of the iceberg of the supply-chain disruption effects rippling out across the global economy, witness China’s spiking producer price inflation (PPI), rising 6.8% year-on-year in April.

Third is the quixotic combination, hitherto unseen in any downturn, of supply constraints occurring just as effective consumer demand is sharply bolstered by helicopter money, the proposed offering of universal basic income, and the possible implementation of modern monetary theory on a longer-term basis. This demand side of the equation is of course bolstered by the monetary supernova noted above. Institutions and individuals flush with nearly costless cash will seek to park it or put it to work in a variety of ways as they see an opportunity to make returns above their extremely low cost of capital. On the margins that implies speculative excess, which is surely one force driving phenomena such as the explosion of crypto and the SPAC mania. More simply it will drive demand for all kinds of tangible assets, just as the supply of those assets is impeded by the pandemic aftershocks. That’s a recipe for inflation.

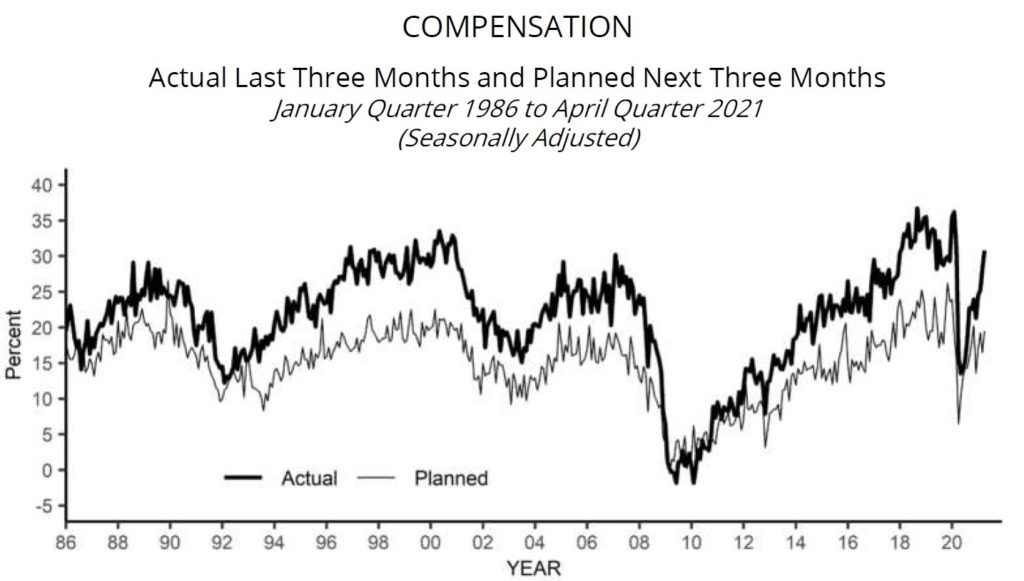

Finally, there is labor. Small businesses report spiking compensation paid to labor, though still well short of immediate pre-pandemic trends:

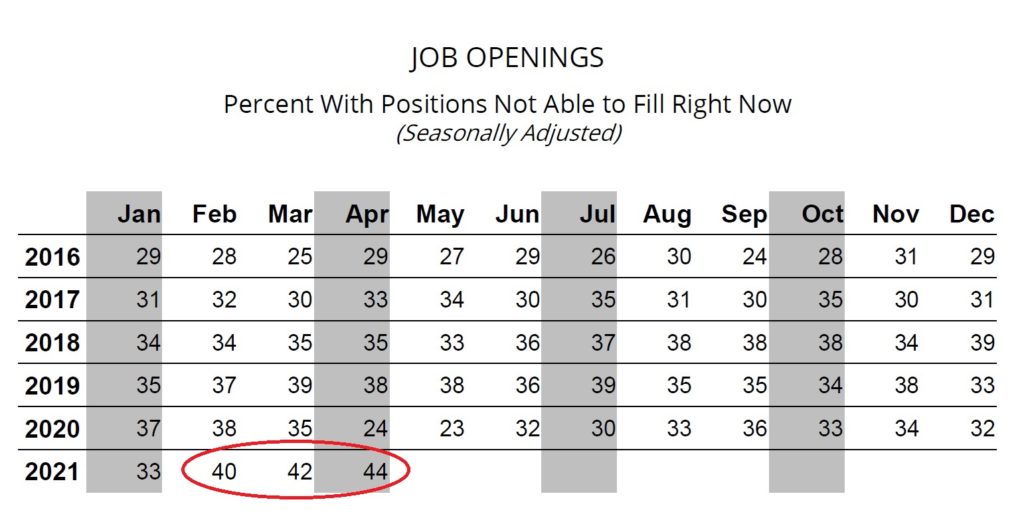

And the pressure being created by unfilled positions suggests that this trend will intensify:

Increasingly, the elephant in the room is the incentivization of continued unemployment by state and Federal assistance. This problem will become increasingly sharp as the year progresses, and politicians will likely find that weaning the population from this pandemic assistance will be a politically difficult pill to swallow. Already California governor Gavin Newsom, facing a recall challenge in the fall, is promising to disburse excess Federal pandemic funds to some state residents as a “one-time” windfall. Cue our habitual discussion of how “government spending plans have no sunset clause.”

The Forces of Disinflation

Of course, there are still epochal countervailing forces working against inflation. These include technology, and to a lesser degree, demographics. In a consumer-driven economy, aging consumer cohorts tend to spend less than the young (with our tongue in our cheek, we might say that’s because they’re less vain); and across consumer, manufacturing, and logistics sectors, technology brings utilities and efficiencies that allow prices to fall. Automation is a key element, whether that means the replacement of human labor or its augmentation; we view artificial intelligence as a species of automation.

Further, some of the inflationary forces will indeed be transitory, as the Fed has suggested. Many commodities, for example, will eventually respond to demand as higher prices stimulate capacity expansion and cause prices to fall again.

These countervailing forces, we believe, will keep inflation from rising to the peaks of the stagflation era of the late 1970s. But that is not to say that inflation will not be an investment theme and a major change from the past 13 years.

Beneficiaries

Early in the inflation cycle, beneficiaries include stocks and real estate, particularly while inflation expectations are still building. Since real estate is typically bought on margin, i.e. with financing, demand for it is intensified by the easy monetary policies that typically prevail at the beginning of an inflationary cycle. Investors will also demand various commodities, including base metals, such as copper; rare earths; industrial and industrial/precious metals, such as silver, platinum, and palladium; building materials; and food grains, as well as potentially other soft commodities such as coffee and sugar. Typically, an inflationary cycle includes rising taxes, and as taxes rise, investor demand will shift to less liquid tangible assets, including collectibles, artwork, classic automobiles, wines, etc. With the rise of decentralized finance and blockchain-based tokenization, some of these illiquid assets may become more liquid, and we would not be surprised to see the current confluence of a nascent inflation cycle and the rise of cryptos accelerate this transformation.

Gold

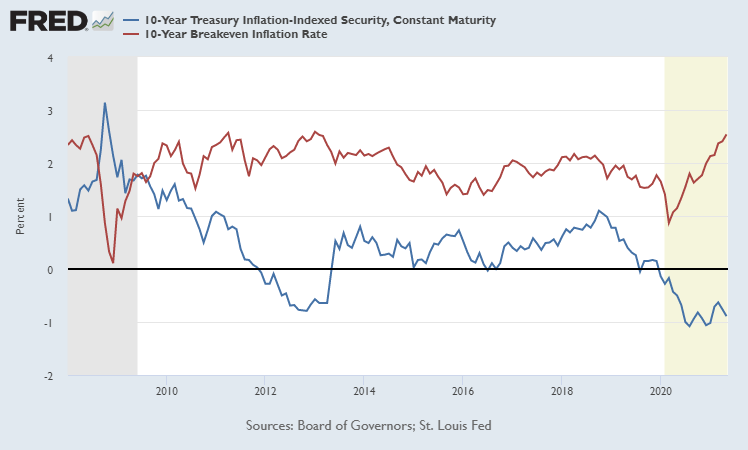

Gold is a special case. Stereotypically, gold is said to be hurt by rising interest rates, which typify the mid-period of inflationary cycles. However, it is important to look at the spread between inflation and real interest rates, and the rate at which that spread is widening.

If inflation is accelerating faster than interest rates, that is very positive for gold, and that is the situation that currently exists. Real interest rates are significantly negative. Therefore our outlook remains fundamentally positive for gold in spite of its sideways performance over the past several months.

Cryptos

We should also mention that cryptocurrencies are a new asset class that has never been in the mix before. As noted above, they are still largely risk assets that are behaving like the poster-children of speculative excess, but under the hood, there are other things going on as well, which investors should not ignore. Cryptos have stolen some of gold’s thunder, and as inflation expectations intensify, they will continue to draw attention.

As we wrote above, there are significant innovations at the cusp of more general adoption in the world of decentralized finance, which is why the Ethereum platform has seen its token far outstrip bitcoin in gains year-to-date. (It is far from obvious to us that the Ethereum network will be the winner in this burgeoning financial space; there are technologically superior competitors, and all entrants in the DeFi race have challenges and problems that have not been overcome.)

Investment implications: In the current phase of rising inflation and inflation expectations, we are looking most closely at commodities and commodity producers, including base and industrial as well as precious metals (copper, rare earths, gold, and silver in particular), energy, building materials, and certain agricultural products.

Infinite and very-high multiple tech stocks will likely return to earth as the theme unfolds, offering investors better entry-points to the best technological themes, including automation, AI, networking, and cybersecurity. As it has been for many months, our fundamental observation is that in the context of unprecedented monetary expansion, it would be foolish to bet against stocks, and we do not believe a crash lies in our immediate future, though of course there will be “normal, natural, and healthy” corrections that feel like anything but while they are unfolding.

We would be remiss not to emphasize once again that as the inflationary cycle unfolds, rates will rise, and thus we are bearish on bonds.

Thanks for listening; we welcome your calls and questions.