About the Guild Basic Needs Index

Guild Investment Management has long believed that the existing indices used to measure cost of living changes in the United States are inadequate and misleading.

For instance, the widely quoted inflation index, the Consumer Price Index, is currently based on data collected from spending surveys gathered by the U.S. Bureau of Labor Statistics from approximately 14,500 urban families. In addition to basic needs, the CPI includes other expenditures, such as insurance and taxes. However, it also includes discretionary spending items such as personal care services and entertainment purchases such as the latest flat screen televisions and consumer electronics.

Another point about the CPI is that the Bureau of Labor Statistics periodically alters its content, making adjustments to the weighting of the components, and smoothing seasonal patterns. Such tinkering with data, as we have mentioned over the years, usually results in an understatement of the inflation rate and creates an unreliable, misleading cost of living index.

We believe a simpler index is necessary for tracking the price changes of basic needs. No such index existed, so we created one: the Guild Basic Needs Index (GBNI). The GBNI will not reflect spending patterns of one segment of the population. Rather, it will measure the changing prices of essential living expenditures. Another key differentiator between the GBNI and the government’s measures is that the components of the GBNI do not change. They are not adjusted, statistically smoothed or manipulated.

The GBNI concentrates on four fixed categories of primary and essential living needs. Each category is assigned a specific percentage of the overall index:

- Food 30%

- Clothing 10%

- Shelter 30%

- Energy 30%

Food, clothing, and shelter are self-explanatory, and energy is needed for basic heating, electricity, cooking, and transportation. The categories and their values within the GBNI are fixed, unlike the government indices. There is no tampering — no seasonal adjusting, smoothing, or replacing of components.

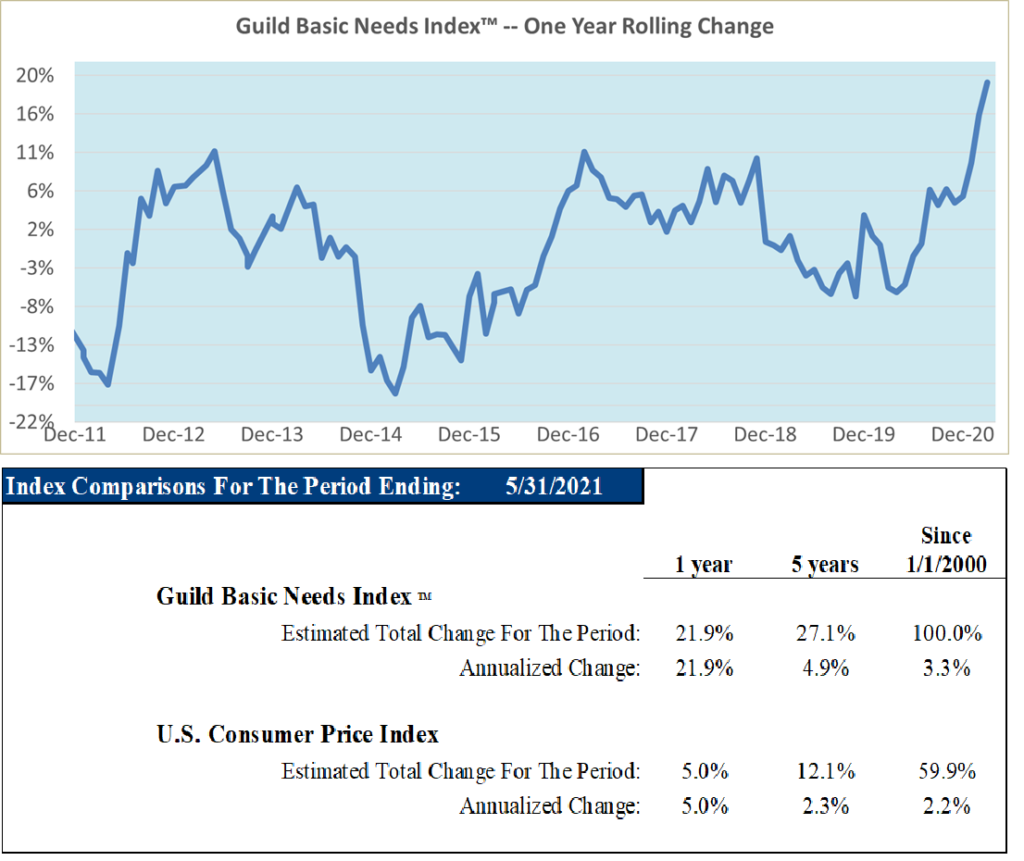

Data through the end of May show our proprietary “real life” inflation gauge, the Guild Basic Needs Index (GBNI), continuing to increase at a recent high pace:

Fed Chair Powell’s remarks yesterday continued to convey the Fed’s conviction that currently observed inflation will be transitory, although noting that core PCE inflation, one of the Fed’s preferred inflation measures, would likely reach 3% this year. In recent meetings, the Fed Open Market Committee had said that it did not anticipate rate rises in the next two years; now two have been suggested for 2023. This, coupled with Powell’s positive comments on pandemic recovery progress, suggested to some that the risk had risen of inflation and higher rates sooner than expected. These two messages — “transitory” inflation, but sooner-than-expected liftoff — may be somewhat contradictory, but they show the difficulty the Fed will experience as it attempts to engineer a safe landing from pandemic support policies.