Two weeks remain until the Federal Reserve’s annual policy meeting at Jackson Hole, from which we may well learn more about the Fed’s intentions on monetary policy.

In the meantime, we note that via various technical mechanisms, the Fed and other central banks continue to control and gradually reduce liquidity, even ahead of any taper in bond-buying or any rise in short-term rates. Whether they can perform this delicate balancing act successfully in the coming months and year of policy normalization is an open question.

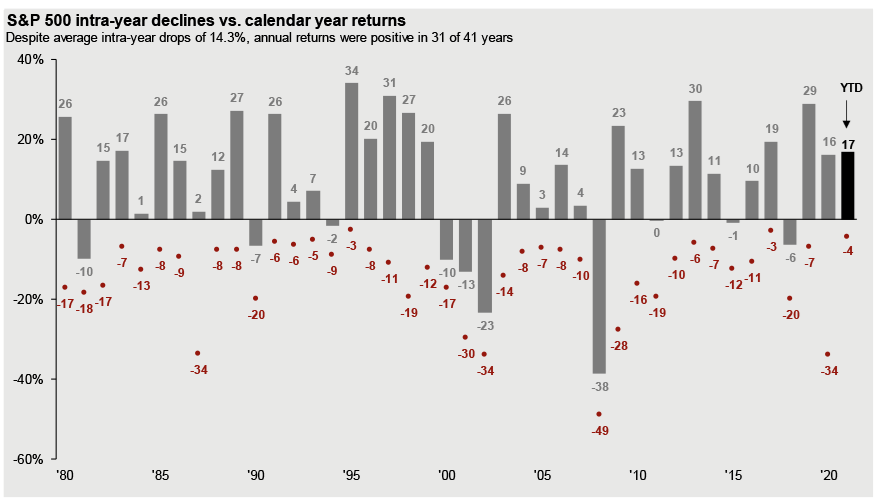

We are mindful that since 1980, there have been just two years that didn’t notch at least a 5% intra-year decline; the average intra-year decline has been 14.3%.

Source: JPMorgan Research

While no one knows what the market will do, we think it’s wise to prepare for eventualities on the basis of long-term historical trends. The confluence of poor seasonality and imminent policy noise — both the Fed and the prospect of a bitter fight in Congress over further stimulus and the debt ceiling — suggests to us that this is a better juncture to work on one’s buy list than to rush out and take on new risk.

We are not pessimistic; we are optimistic about a variety of areas, some of which we mentioned last week. Besides education technology, which we discussed above, we continue to like tech growth (at a reasonable price); healthcare, and particularly, technologically disruptive healthcare; and tech related materials, particularly copper, lithium, and rare earths.

Thanks for listening; we welcome your calls and questions.