This past weekend we were invited to present our views on the current investment landscape to the local chapter of the American Association of Individual Investors (AAII). As our title indicates, there are many macro factors at work, all of them of fundamental interest to investors. How do we rank them in importance, and how do we see them affecting on another? What should investors be watching, and what should they be watching out for?

Cage Fight: Earnings vs Rising Rates

The decade-plus since the Great Financial Crisis has seen several episodes that are instructional for our current situation of rising rates. Bear in mind that the most significant factor at present is not the “first derivative” — rates themselves — but the second derivative, that is the speed with which rates are changing.

Here is an illustrated narrative of one of those episodes.

In 2013 and 2014, markets enjoyed the abundant liquidity of QE, a vigorous economy, and steadily rising earnings.

Black line = SPY; tan line = S&P 500 earnings per share

Source: Bloomberg, LLP

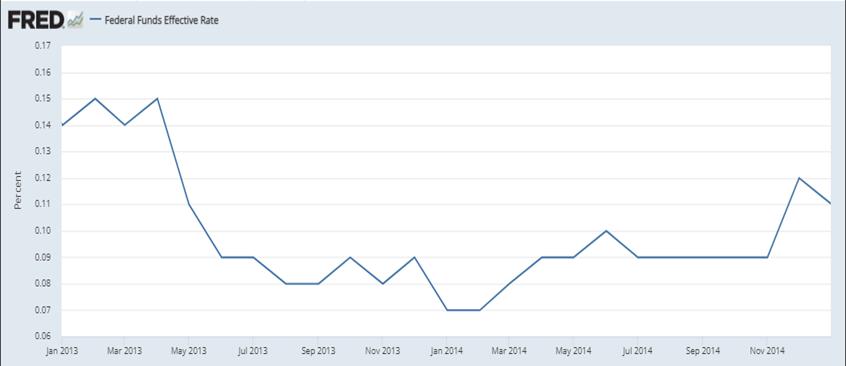

During this period of rising earnings, rates were cooperative:

Source: Federal Reserve Bank of St Louis

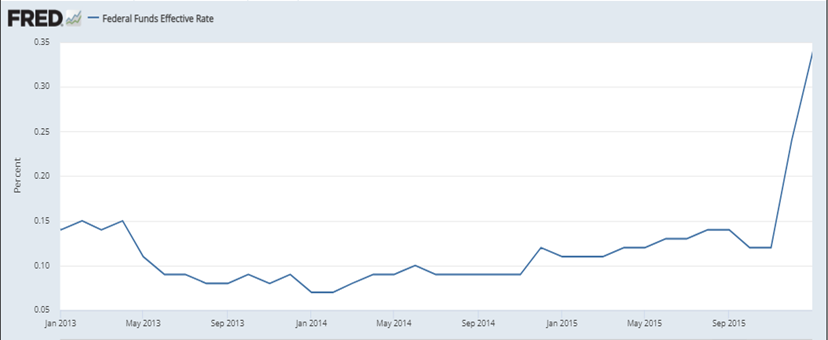

However, at the beginning of 2015, earnings stalled, and the market followed suit, also anticipating the rate rises that were to begin later that year. This was the beginning of a volatile, unpleasant, and unproductive period for the broad markets.

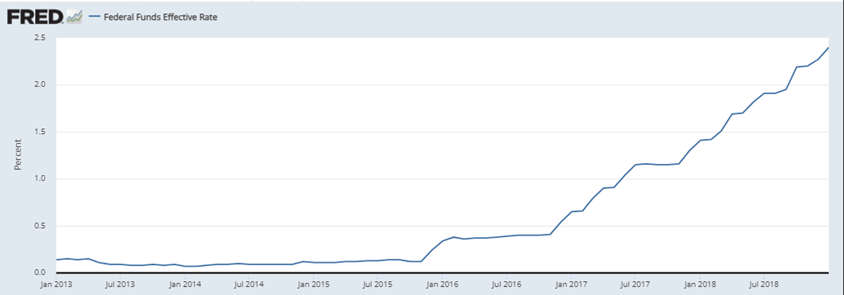

Then, even though rate rises continued to march higher…

…earnings growth reaccelerated, and with it, the market — until the Fed’s policy snafu at the end of 2018.

Rising rates — and particularly, rates that are rising at an accelerating pace — can and usually will spook markets in advance, as we can see happening right now. However, it is also important for investors to watch both index-level earnings trends and the earnings of the specific companies in their portfolio and watch list.

We note that 2021 saw robust earnings growth — at the index level, earnings per share for the S&P 500 were up about 45%. The market’s rise in 2021 was powered by earnings, not just by multiple expansion. Estimates for 2022 are in the 6–8% range. Of course, that is still positive, but it is a sharp deceleration. At the same time, the market is digesting the likelihood of impending rate increases. All in all, this is a setup for a markedly different year than 2020 or 2021.

Investment implications: After a year of stock market performance driven by strong earnings growth, this year’s landscape presents both rate fears and slowing earnings growth. Layered on top of that are political trends that suggest a coming shift in the free-spending largesse of the past two years (a short-term negative) — but also potential shifts in tax and regulatory policy (a medium- and long-term positive).

All of this amounts to an environment of significant uncertainty, which is not an environment of smooth, uptrending markets. The current correction is still quite typical of corrections early in the new year after a strong up year; we would not be surprised to see this correction deepen, and to see further corrections in the course of the year.

2022 could be a year in which broad markets struggle to go sideways, and the indexes produce a lot of anxiety on the way to going nowhere. There will be opportunity in particular sectors, industries, and companies that are well-situated for the environment. We don’t believe it’s yet time to be buying long-dated themes (in tech, for example); although some of the high flyers have dropped, they haven’t dropped enough.

Right now, we’d be focusing on strong earnings, strong balance sheets, companies without labor issues, financials (regional banks are particularly interesting), industrials, some legacy carbon energy producers, and some base metals (as China begins easing). We would keep tech themes on close watch, but looking for a more durable bottom — when earnings have begun to grow more rapidly again, and the market has grown comfortable with anticipated 10-year rates approaching 2.5%.