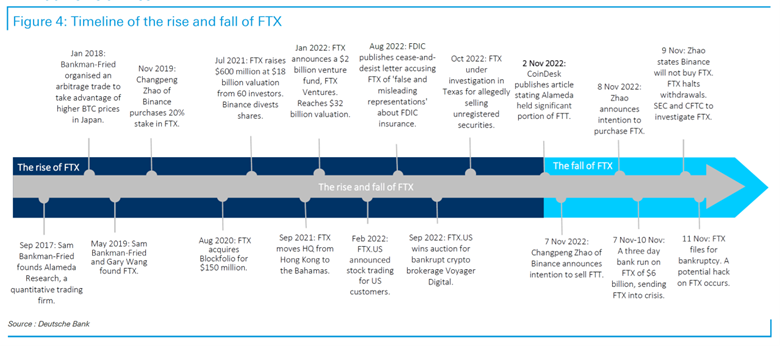

The ripples continue to spread from the collapse of what has now been revealed as an epochal fraud at FTX, formerly the world’s third-largest crypto exchange. The first blow came with revelations on the CoinDesk website, which had obtained a balance-sheet of FTX’s crypto hedge fund, Alameda Research, suggesting it had borrowed funds from the exchange and collaterized them with the exchange’s own token. (If that sounds incestuous, it is; as Deutsche Bank drily observed, “In the more heavily regulated finance space, this type of financial tie between an exchange and a speculative trading firm is not typically allowed.”) That revelation led rival exchange Binance, which held a considerable position in FTX’s native token, to announce that it was liquidating that position; the subsequent collapse in that token’s price and rush of clients to pull funds off the exchange ended in its collapse and suspension of withdrawals. To students of financial history, it looked like a classic pre-modern bank run… with some very 2022 accoutrements.

FTX is now shuttered and has filed for bankruptcy, and its principals’ movement reportedly restricted, pending likely criminal charges. Sam Bankman-Fried — the MIT wunderkind who founded the exchange after earning his bona fides arbitraging trans-Pacific bitcoin price differentials — is joining the ignominious ranks of Madoff-tier hucksters, having bilked bag-holders investors for billions of dollars. (Is he actually a long-lost cousin?)

Bernie Madoff (Left) and Sam Bankman-Fried (Right)

FTX rose to prominence very rapidly at the beginning of the last crypto “cycle,” quickly acquiring a reputation for regulatory compliance and, indeed, for its efforts to expand crypto regulation and mainstreaming. Bankman-Fried became a highly visible spokesperson on Capitol Hill and at the White House, lobbying and arguing for the integration of crypto into the U.S. financial system’s regulatory framework.

Now, of course, with the criminally lax internal controls at FTX revealed for all to see — and the almost comical unsavory details of the principals’ private lives exposed on social media — it seems that all the politicking functioned well to shield FTX from closer scrutiny. (Indeed, one might suspect that Bankman-Fried was angling to set up a two-tier system in which FTX was accorded special treatment by regulators.) There is a long “walk of shame” of high-profile financial firms and celebrities who have incinerated monetary and social capital in the FTX dumpster fire. (As one wit put words in the mouth of FTX’s institutional investors: “How did you convince us that a bunch of Millennials on Adderall was the future of finance?”)

Source: Deutsche Bank Research

In the wake of the collapse, besides the egg on the face of those institutional investors and social-media influencers, a new shadow has fallen on much of the rest of the crypto universe. A movement has accelerated which has seen billions of dollars withdrawn from exchanges to private wallets. That indicates a generalized anxiety about the safety of assets on all exchanges — even those with clean reputations such as Coinbase [COIN] and Gemini. After all, prior to this suddent collapse, FTX also had a clean reputation. Yesterday, even Gemini saw its Earn crypto yield product suspend withdrawals, suggesting that the contagion has further to spread.

Open Minded to the Digital Money Revolution — But Taking a Belt and Suspenders Approach

It is worth reiterating that assets held on crypto exchanges are only as safe as those exchanges’ internal controls and externally verified compliance practices. This is why from the beginning of wide-scale interest in crypto among investors, we have said over and over again that investors should only use U.S.-domiciled and regulated exchanges, and understand even then that they were entering a very lightly regulated space with higher risks. FTX presented the appearance of compliance without the substance of it. We particularly preferred the transparency and institutional depth that we saw developing at COIN after its debut as a publicly traded company.

But when we step back, we see the emergence of even bigger problems. None of these are surprising, because they are manifestations of fundamental aspects of human nature: namely that, in the absence of effective regulation, there will be people who will exploit any system through fraud and manipulation if they can — and they will be ingenious and tenacious in finding ways to do so.

Crypto promised that “decentralization” would allow financial systems to be “trustless” — that is, that digitization and automation would obviate the need for trusted, vetted, regulated intermediaries in financial transactions (and indeed, all other transactions requiring the same trustworthiness and security, such as credentialling and voting). This is the claim of “DeFi” (decentralized finance) — “it’ll be faster, cheaper, and safer, through automation.” Verifiable and unhackable computer code was to replace the legacy financial system and its expensive, cludgy infrastructure of humans, desks, and files.

Just under a decade into the rise of DeFi, how is that working out? Some pro-crypto observers claim that all the high-profile crypto frauds and thefts have in fact been related to “CeFi” — that is, digital assets and digital asset platforms that are not decentralized but rather are centralized under the control of human actors. That was certainly the case for FTX; Bankman-Fried had built in “back doors” allowing him to funnel funds off the exchange into the coffers of Alameda Research without sounding compliance alarms (if there had been any genuinely independent compliance auditors paying attention — according to reports we read, the offices of FTX’s auditor were in the metaverse.).

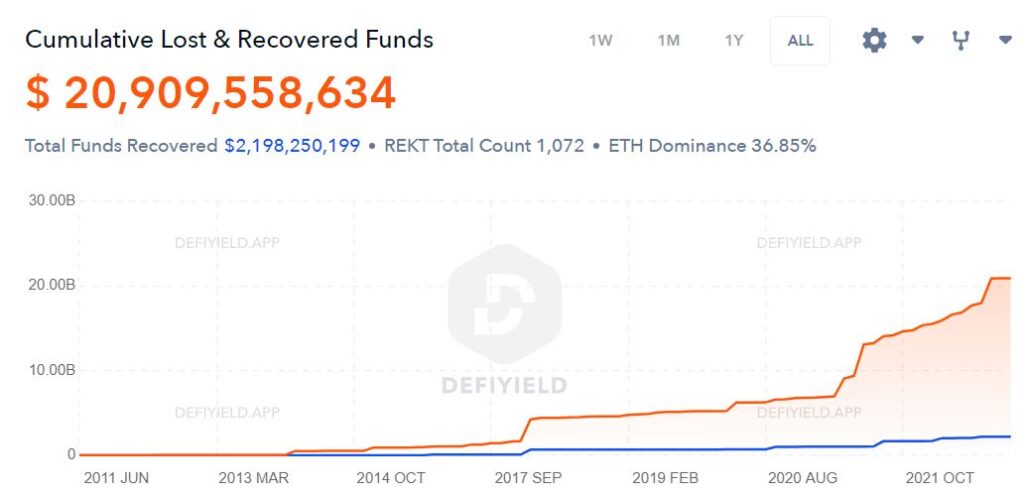

But sadly for its uncritical proponents, DeFi has not met its boosters’ claims. The red line below shows the current cumulative dollar value of unrecovered DeFi hacks and scams; the blue line of recovered funds. Notably, this database is compiled by a pro-DeFi trade association that believes transparency will ultimately be friendly to the industry.

Source: Defiyield

This chart illustrates why, as a firm, we have always regarded due diligence as essential in evaluating digital assets and digital asset platforms. The cost of due diligence is that you sometimes seem to miss a speculative opportunity. But when the comeuppance eventually arrives, you’re often happy that your care kept you out of danger.

In the language of cybersecurity, crypto has simply created a larger “attack surface” for criminals. In the end, the ideal of DeFi means at best not that you have moved from trust to trustlessness, but that you have moved from trusting established financial institutions and regulatory infrastructure to trusting forensic code auditors. In short, your capacity as a layperson for evaluating the trustworthiness of a given entity has become significantly impaired — and on top of it, you have entered a space where regulators and regulations have largely been MIA.

“Trustlessness” is a chimera. You will always be trusting someone (even if it is the coder and builder of your hardware crypto wallet.)

This is a manifestation of what realists have long understood about anarchy. “Anarchy” as preached by anarchists — a Utopia which we would enjoy but for the depredations of “authoritarians” — in practice, always gives way to the rule of force and fraud. Effective and just regulation is the friend of liberty, not its enemy.

So what this really means is that DeFi is simply a technological fight between established actors on the one hand, and the upstarts who want to expropriate them on the other. It is just the eternal dance of “creative destruction.” Some of the leaders of the would-be new financial world are honest, and some are fraudsters — but even the honest ones are making a basic pitch that “they can do it cheaper and better” and therefore they deserve your business. They have not proven their case.

This is not to say that the technological innovation is valueless — on the contrary; it is extremely valuable. The technologies underlying current DeFi protocols and platforms can in principle make for faster and cheaper transactions. The crypto critics’ points that money should move at the speed of the internet are correct. However, the Utopian plans are disingenuous. They are saying, “Trust no one.” But they really mean, “Don’t trust them; trust us.” And they have now amply proven that without the same stringent regulations that are applied to the legacy financial system, they are unworthy of anyone’s trust.

Therefore, we believe that the collapse of FTX will provide a catalyst for the mainstreaming of crypto in the following sense. Regulators may have been hesitant to legitimize an area they could not effectively enforce, but the process of enforcement will be accelerated as (1) the traditional financial system brings digital asset innovations in-house and deploys them within its regulated framework; and (2) the new “digital asset natives” need to be brought firmly and completely within the regulatory fold — with prejudice, we might say.

FOMO Caused Some “Smart Money” to Forgo Discipline and Rigor

Further, the highly regarded institutions that piled into this space during the years of exuberance and central-bank fueled infinite free liquidity will, under current conditions, go away to lick their wounds and eventually find other speculative opportunities. That will happen both because of financial constraint (higher inflation, higher interest rates, tighter central bank policy, more sober valuations) and because regulation will douse the speculative mania and make digital assets… boring.

In brief, digital assets are about to move from speculative fun house to a mere sub-industry within “fintech,” or financial technology.

Tighter crypto regulations at this point are the best-case outcome for the industry. Unfortunately there is already talk among regulators that regulation would merely be legitimization. That implies that regulation, when it comes, will not be the warm and fuzzy embrace for which the disgraced CEO of FTX was lobbying — it will likely be altogether colder and harder.

Two further observations are relevant.

First, Bitcoin rises above the fray. Current events are a booster for the “bitcoin only” crowd, who have long maintained that DeFi is a blunder at best, a scam at worst. Indeed, in the face of DeFi and exchange hacks and frauds, the bitcoin blockchain and algorithm stand supreme and inviolate. Obviously, the price of bitcoin was bid to irrational levels as part of the exuberance, and certainly reflected fraud, hyper-leverage, and manipulation. But we believe that bitcoin itself will have an enduring, if now reduced, role to play in the global financial system and for investors seeking a form of diversification in their efforts to defend themselves against currency debasement. However, it will not be a playground for speculators; those days, we believe, are done.

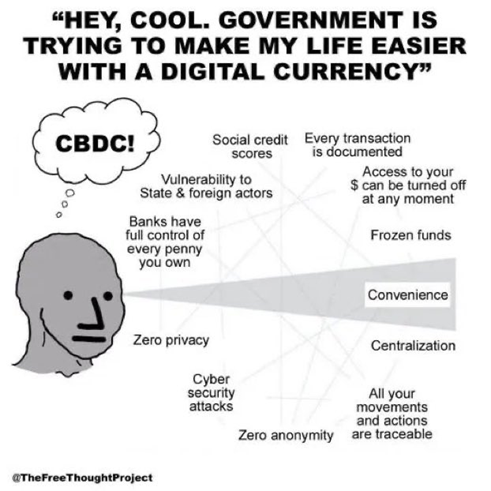

Second, the elephant in the room, as we’ve been pointing out for a long time, is the rise of CBDCs — “central bank digital currencies.” We find it difficult to allay our sense of eerie timing in the announcement of a Fed “digital dollar” pilot program with the New York Fed and major mainstream financial firms such as Mastercard, Wells Fargo, Citigroup, and others — right after the dramatic collapse of FTX. The message we receive is, “Your private-sector efforts are untrustworthy; we’ll give you a real digital currency.” While this may be far off, it is something to be aware of and concerned about, for the reasons summarized in this meme:

Similar concerns were voiced by Minneapolis Fed Chair Neel Kashkari, who observed that he could understand why an authoritarian government would want a CBDC, but not why the United States government would want one. (He pointed out that the conveniences of a CBDC are largely already available in the legacy financial system.) We hope that even if CBDCs are inevitable, public concerns will result in adequate privacy enhancement to whatever protocols are eventually implemented. But there is no doubt that the FTX debacle is a major step backwards for private-sector involvement in digital money.