The U.S.

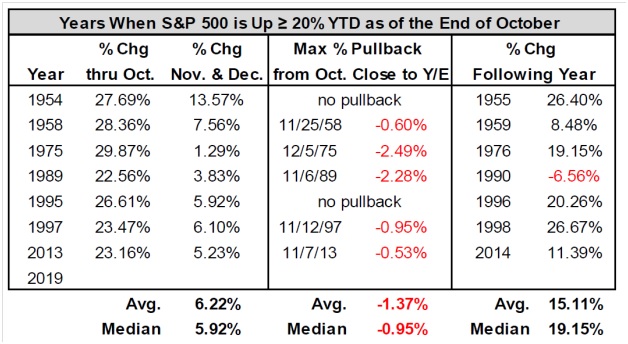

With most major indices having pushed to new highs, a modest correction of a few percent is possible at any time. Still, we anticipate that by the end of the first quarter of 2020, the U.S. stock market as a whole will likely be 8–10% higher than today, and possibly much more. The historical data are limited, but suggest that after a big year through October, strength lies ahead in November and December, and the subsequent year is strong as well:

Of course, some stocks will rise considerably faster than the broad indices.

The U.K.

The U.S. remains by far our favorite stock market. Elsewhere, the only investment destination that may be attractive is, we continue to believe, the U.K., which has been punished for the ongoing turmoil of Brexit and its attendant political strife. Many stocks in the U.K. are attractive dividend yielders, and we see upside post-Brexit for both the stock market and the currency.

Gold

Gold has two strong supporting trends: negative yielding debt and rising inflation. Inflation is currently not rising in the U.S. or elsewhere in the developed world. And now, we note that the global total of negative-yielding bonds has fallen to about $13 trillion from its summer high of about $17 trillion. Rates have risen in some negative-yield superstars, such as Japan and Germany. Against this backdrop, gold has struggled, trending sideways to down from its September peak.

Additional influences on gold are trade and the U.S. dollar. A partial trade settlement between the U.S. and China or a stronger dollar would be negative for gold.

We continue to see possible medium-term tailwinds for gold, but while rates are rising, and the U.S. stock market is running, gold will likely continue to languish in the near term. Technically, gold’s recent pullback was not encouraging, and one must watch the charts carefully to make sure that it doesn’t break $1434 — which could then lead to a break of $1400.

Thanks for listening; we welcome your calls and questions.