The U.S.

U.S. stocks continue to forge ahead. In the ebb and flow of news related to trade, impeachment, geopolitics, and the 2020 election, we continue to note underlying reasons for strength. (Of course, the market may decline by 1–4% at any time).

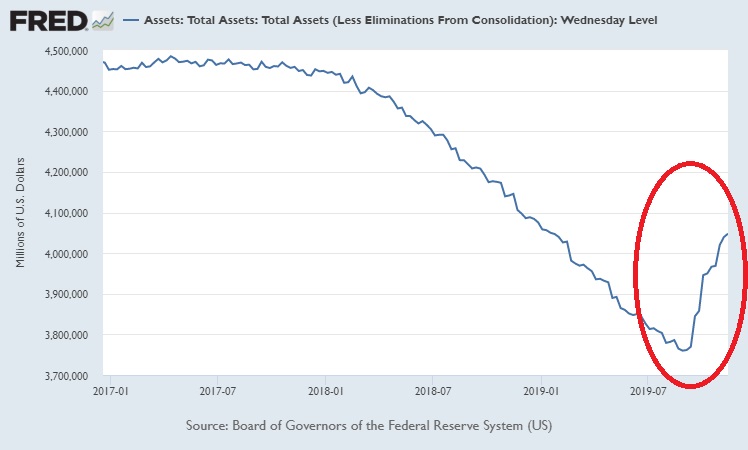

One of these reasons is the perpetually relevant axiom “Don’t fight the Fed.” After the September liquidity crunch, and in line with what we told you to expect in our September 26 edition of this letter, the Fed began to expand its balance sheet again in early October. As you can see from the chart below, the past weeks have seen the Fed undo about 40% of its two years of “quantitative tightening” (QE reversal).

Fed Chair Jerome Powell does not want to call it QE, but what it’s called doesn’t matter much; the effect is the same. Easing by any other name, is still easing. Don’t fight the Fed!

We note also that the U.S./Mexico/Canada trade deal is still waiting to be taken up by the House of Representatives. Other legislative priorities seem to have intervened, which is unfortunate for American workers and businesses. Most likely, its passage (which although delayed remains likely in our view) will be positive for employment, capital investment, and GDP growth.

The U.K.

U.K. politics are favorable for a good showing by Conservatives in the upcoming general election, for the passage of the Brexit deal, and for Brexit to occur early next year. We reiterate our bullish sentiment on U.K. equities and the pound, as the U.K. emerges from the political clouds and poor sentiment of the prolonged Brexit battles.

China

An interesting anecdote came to our attention in a video interview with European and Australian ex-pats living in Shenzhen, the “Silicon Valley” of mainland China that lies immediately to the north of Hong Kong. Two things to bear in mind: (1) the Chinese government has an extensive facial recognition system, and cameras exhaustively monitoring many of its urban areas, and (2) in China’s urban hubs, most businesses and citizens have stopped using cash and credit cards, and instead use mobile payment apps — particularly Alibaba’s Alipay [NYSE: BABA] and Tencent’s WeChat [OTC: TCEHY].

The ex-pat recounted an occasion on which he jaywalked, which in Shenzhen as elsewhere is against the law. Less than a minute later, a jaywalking fine was debited directly from his mobile payments account. He had been photographed, identified, and fined — all automatically.

So if you visit the PRC, be sure to stay on the straight and narrow!

Gold

Gold is consolidating; it now lacks bullish support from a weak dollar, inflation, increasing negative interest rates, or an escalation of trade problems. (Indeed, as we noted above, it’s likely that the U.S./Mexico/Canada pact will be signed). Both the world economy and the U.S. economy are likely to improve slightly in 2020. All of these trends are not supportive of gold. In our view, those with tactical gold allocations can hold their positions, but should watch support at $1440, and sell if it breaks.

Thanks for listening; we welcome your calls and questions.