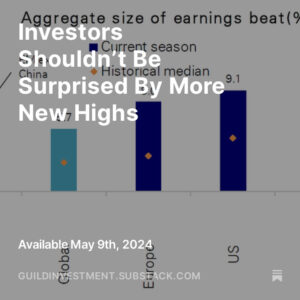

The message from earnings season is clear: the negative earnings impact of the pandemic, index-wide, is over. The chart below shows annualized two-year EPS growth.

Source: Deutsche Bank Research

What remains for investors is first, not to be prematurely spooked out of a market in which sentiment and liquidity are still in the driver’s seat, despite ominous domestic politics, ominous geopolitical events, and troubling long-term macro fiscal and monetary trends. These things don’t matter until they do, and they don’t matter yet. Seasonality and near-term events (e.g., Jackson Hole, debt ceiling battles) argue that this is a time to study the buy list rather than to dive in to markets just off all-time highs. Sentiment and liquidity argue that declines will be relatively shallow and brief, and that investors should be buyers.

The second item that remains is to put the investment emphasis where it’s deserved. In our view, sentiment and liquidity both still favor the disruptive pandemic beneficiaries — mostly mega-cap tech. Tech remains the overriding theme, and wherever a compelling story is to be found, disruptive tech is almost invariably at the core.

We continue to look for disruptive tech opportunities beyond the mega-caps — in business process digitization, business and consumer payments, tech-related materials, innovative hardware, decarbonization and other ESG themes, tech-enabled healthcare, innovative biopharma discovery and development platforms, and companies with valuable and under-appreciated data troves.

As we noted above, we don’t believe bitcoin will ever be capable of a role as a reserve asset. That doesn’t mean that it has no role to play in defense for individual investors; it does, and likely so do other mega-cap cryptos. DeFi will continue to grow inexorably in spite of the recent Polychain hack; these are normal technological growing pains, and someday, history will look back on them with the romanticism we now reserve for the great bank robbers of the early 20th century. Incrementally, crypto will continue to take some of the defensive funds that would have flowed to gold.

Thanks for listening; we welcome your calls and questions.