Agustin Carstens, the General Manager of the Bank of International Settlements (BIS), spoke in Geneva a week ago — offering some soul-searching reflection on how the world’s financial authorities got the inflation story so terribly wrong. (The Bank of International Settlements is essentially “the central bank of central banks.”)

We gave you early warning, long before the “experts” changed their tune — our note on January 7, 2021 announced the arrival of a sea-change in inflation that we said would have profound and lasting effects.

Carstens noted last week:

“…We may be on the cusp of a new inflationary era. The forces behind high inflation could persist for some time. New pressures are emerging, not least from labour markets, as workers look to make up for inflation-induced reductions in real income. And the structural factors that have kept inflation low in recent decades may wane as globalisation retreats.

“If my thesis is correct, central banks will need to adjust, as some are already doing. For many years now, having conquered inflation, they have had unprecedented leeway to focus on growth and employment. Indeed, with inflation stubbornly below target, stimulating activity hit two birds with one stone. But this is now no longer possible, since low and stable inflation must remain the priority. If circumstances have fundamentally changed, a change in paradigm may be called for. That change requires a broader recognition in policymaking that boosting resilient long-term growth cannot rely on repeated macroeconomic stimulus, be it monetary or fiscal. It can only be achieved through structural policies that strengthen the productive capacity of the economy.”

We monitor business, consumer, and union sentiment and communications, both within the U.S. and abroad. This close-to-the-ground intelligence confirms the BIS’ observations: the fracturing of trade relationships due to sanctions, covid-related logistics bottlenecks, the shift from just-in-time to just-in-case inventory strategies, and changes in labor dynamics — including “the great resignation” and increasingly entrenched worker anxiety about the rising price of consumer necessities… all these things are at work behind the inflation regime change.

Guild’s Basic Needs Index [GBNI], our in-house, real-world inflation gauge, focuses on the “hotter,” more volatile, and more quotidian elements of inflation, and alerted us to this process early. The kicker, as the BIS observes, is that rather than moving from services to goods and then rebalancing itself as the pandemic restrictions and dislocations rolled off, both goods and services demand has remained elevated. This was one of the key reasons why the Big Thinkers and Big Modelers in government and academe got the inflation call so wrong. Carstens again:

“Household spending on goods had been declining relative to services for several decades before the pandemic. Instead of households returning to their old patterns, the share of spending on goods generally remains well above pre-pandemic levels, although it dipped somewhat in the past year.

“The goods-intensive nature of the expansion has added to inflation. It meant that some industries returned quickly to full capacity, leading to rapid price increases, even while economy-wide indicators pointed to continuing slack. Faster price growth in sectors where demand was strong was not offset by slower price growth in lagging sectors, not least as in service industries prices are relatively sticky. This may help explain why observers relying on aggregate measures of output or employment slack failed to foresee the rise in inflation.”

That last sentence is critical. The people making predictions usually work from macroeconomic aggregates that can conceal critical variability in underlying details that actually show a totally different picture. It’s the same reason why a market that is still trending up as far as broad indexes are concerned can mask deteriorating conditions that reveal themselves on the granular level of individual company performance and reporting.

The Real Economy Bites Back

Also relevant here is the so-called “revenge of the real economy.” The ultimate solution to elevated prices caused by elevated demand is capacity expansion. And the problem with capacity expansion is that for a variety of reasons — economic, financial, and political — commodity producers have been hesitant or hindered in their willingness and ability to expand production.

A great deal of that responsibility has to fall on the rise of environmental criteria in investment allocations. We have no argument with the trend toward decarbonization, the electrification of transport and industry, etc. We view it as inexorable. However, the transition has largely been driven by very urgent political demands, which have in turn altered the investment landscape and made capacity expansion difficult for legacy commodity producers. At the same time, their products remain critical for the global economy and will remain so for decades to come.

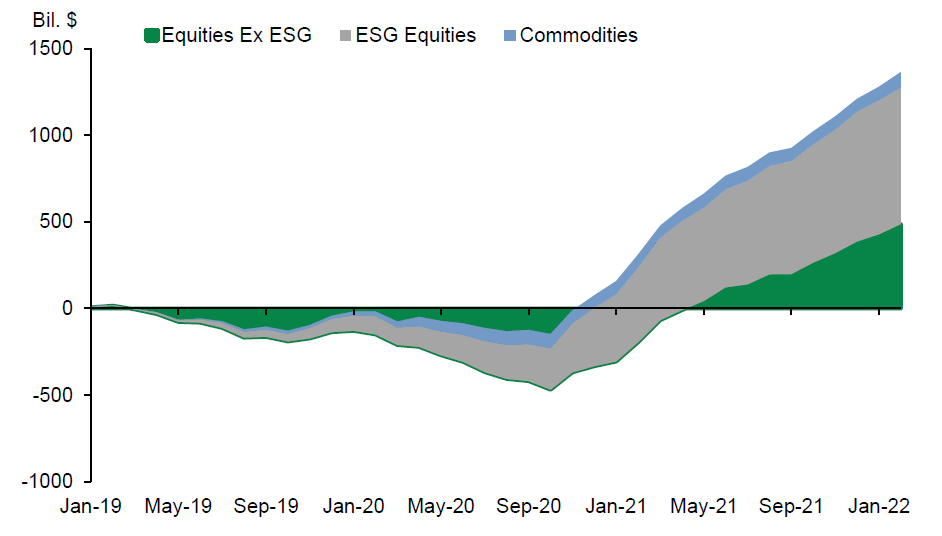

A more rational “glide path” would have seen restrictions phased in in such a way that critical commodities were not abandoned by capital allocators. Today’s rising prices are just the beginning of a consequence of this foolhardy policy trajectory — and since it can take years for renewed capex to come online, we emphasize the word “beginning.” Here’s an illustration: capital inflows to ESG funds, versus the broad markets, versus commodities.

Cumulative Fund Flows to ESG, Broad Indexes, and Commodities

Source: Goldman Sachs Research

Now, commodity demand is unrelenting and the commodity sectors are starved of capital, and rising rates and receding liquidity portend a period of generally more scarce and expensive capital. All of this implies, to us, that we are in the early innings of commodity upside price pressure.

Further, high demand for commodities and supplies constrained by inadequate capex suggest a lack of supply buffers to smooth volatility — so that ensuing volatility will also dissuade large investors who habitually (and wrongly) calculate risk simply as a function of price volatility (so-called “value at risk”). So it is likely that volatility will rise, further “scaring off” investors.

All of this spells big opportunity for small investors who take a medium to long-term view and are willing to weather that volatility, or who have the touch to trade it. Commodities remain deeply underinvested. Investors should position themselves on the opposite side of that mistake.

Rhyming With the 1970s

We noticed this process — inflation getting entrenched via rising wage demands — in the 1970s, and we are seeing it again. Central banks are slow to move with such epochal trend changes, and economists rely on historical data (often deceptively aggregated data, as we noted above). Further, central bankers are appointed by political groups which are not anxious to admit mistakes, nor to do the hard and unpleasant work of cutting inflation (which almost always results in a recession). Almost all U.S. recessions over the past 50 years have come from efforts to rein in inflation, or curtail excessive risk-taking in the financial system.

We have no doubt that the U.S. will enter an earnings recession very soon, as we pointed out in last week’s letter. The beginning of a decline in U.S. GDP for two or more quarters lies ahead — probably within a year. Even the members of the Federal Reserve — who were so wrong about inflation, and who are now only gradually beginning to change their tune about the actions needed to stop inflation — still have unreasonable objectives about how high interest rates will have to go to actually return inflation to a 2% annual path.

Indeed, the adoption of “average inflation targeting” by the Fed is now a dead letter. Remember that in November last year, the Fed changed its inflation targeting policy to one where inflation would average 2% over an extended (but unspecified) timeframe. The inflation that’s happened so far has already carried us well above a long-term 2% trend.

Inflation Will Remain Elevated

Due to central bankers’ analytical failure, slowness, and timidity, we anticipate that inflation will still be 4–5% into 2024. This means that Fed Funds rate is going to have to go much higher that the 2.5% that Wall Street is currently expecting — but markets are only reacting as if it will rise to perhaps 1.5% before the Fed caves in and begins easing again via a bout of QE. Between now and 2024 we see no way to stop inflation unless rates go much higher than markets are expecting.

Many money managers argue that inflation will play second fiddle to income security and economic growth, and that after rates rise 1–2% more from here, a market dislocation, banking problem, or economic swoon will develop, and the Fed (at the suggestion of political powers that be) will move to add liquidity by once again ramping up the expansion of its balance sheet, buying bonds and possibly stocks (as the Central Bank of Japan has been doing for years). If that happens, inflation will be with us longer, and become very much more difficult to return to the 2% level.

Economic Stagnation Plus Inflation Equals… Stagflation

Given our stagflation outlook, the U.S. economy will be sluggish. This would argue against commodities, but inflation — and the supply and capex constraints we described above — will be strong, and this argues for commodities. We think the latter considerations outweigh the former, particularly for specific areas within the commodity complex.

We continue to like commodities that are involved in electrification: copper, zinc, lithium, and rare earths. We like oil and uranium. Uranium and nuclear power — to us and increasingly to policymakers even in formerly skeptical countries — will be critical components of global energy supply moving forward, as essentially the only fully reliable non-carbon baseload generation technology. Uranium is an interesting corner of the market — speculative opportunities are many, but high-quality investment opportunities are limited.

We also like commodities that benefit from distrust of governments’ economic management skill: gold , silver, and bitcoin. (We like some other cryptocurrencies and decentralized finance platforms on a speculative basis; see our notes below.)

Commodities can have corrections, and after their rapid run-up many are likely due for corrections, so buy the dips. We believe you’ll be rewarded if, as we anticipate, this new inflationary environment lasts above 2% for a decade or more, and above 4–5% for several years.

We expect price-to-earnings ratios to return to a more normal range, with a market multiple of 18–19 on the S&P 500, and much lower valuations on the stocks of tech companies whose profitability is five years out in the future. Still, as we always say, we are in the midst of a major technological revolution, and companies in the forefront of next-gen networking and processing, business digitization, artificial intelligence, automation and robotics, cybersecurity, biotechnology, financial technology, digital finance, and similar industries will eventually be buys. As we’re in the early innings of rate rises, though, we don’t think the time to dive in has yet arrived.

Our Next Zoom Call

We’ll be hosting a Zoom call on May 5, following the Fed’s next meeting, to discuss current market dynamics and outlook — and especially all topics related to inflation and investors’ responses and adaptations to it. Please register for the call, and send your questions to guild@guildinvestment.com.