What is Happening In China?

Shanghai, and many other Chinese cities, are once again under extreme covid lockdown conditions — the most stringent since April 2020, as China pursues its apparent “zero covid” policy. The images and videos percolating through to western social media are profoundly disturbing, and prompt a question: what is China really up to? As the rest of the world has largely settled into an acceptance of covid as a new, endemic, dangerous, but manageable seasonal illness, and has rolled off restrictions and mandates and left such decisions to individuals, China has crushed economic and shipping activity in its most economically significant city. Why?

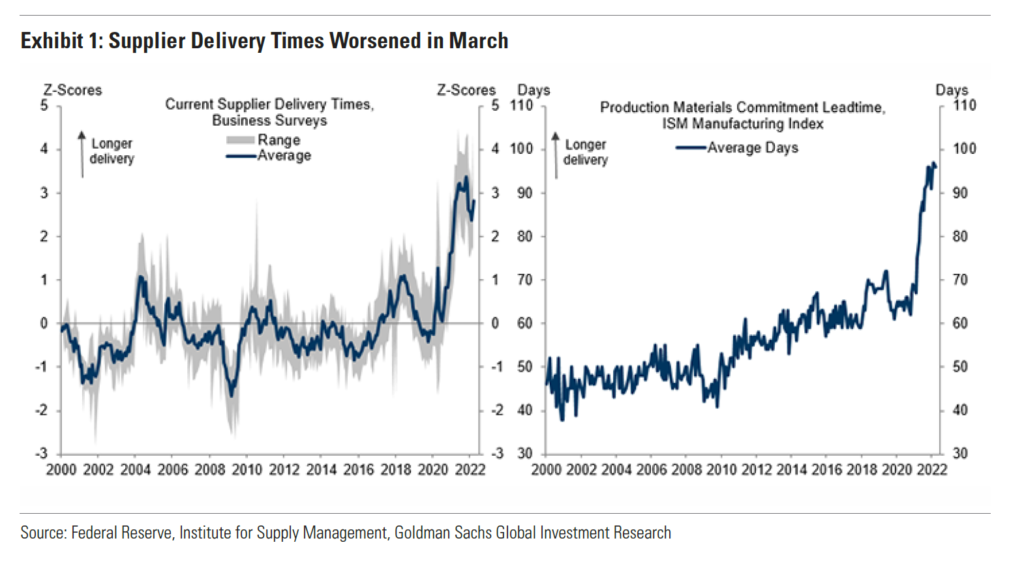

We have some conjectures – an effort of the Chinese leadership to assert and secure control, an act of solidarity with Russia, an act of telegraphing the west’s economic vulnerability and dependency on China. Or is (as some may fear) their “zero tolerance” covid policy driven by some particular knowledge that they have about the long-term effects of the pathogen itself? All of these are no more than conjectures. In any event, the effect on global supply chains — which had begun to unsnarl the original pandemic knots — will be significant moving forward. Global auto production is already declining again, both due to supply chain disruptions and due to raw material disruptions from the Russia/Ukraine war.

Source: Goldman Sachs Economics Research

Investment Implications: Invest in China at your own risk, but follow China closely as it holds many global economic keys.

China watchers are trying to figure out what comes next, and there are lots of theories and guesses. Bank of America Merrill Lynch shared a few possible scenarios with investors this week, saying “uncertainties to persist,” “base case: lockdowns till mid-May and reopening in 2023,” and “bear case: lockdowns to spread until reopening at yearend.” Our strategy is to follow the data (as unreliable as it may be), and while China could decide to stimulate aggressively; and China-related stocks could be a good short-term trade, we typically want to choose investments that offer more transparency than one finds in China.

How’s the Consumer?

Corporate earnings season has started, and in management conference calls we are getting signals that discretionary consumer spending is beginning to show some cracks — here’s looking at you, NFLX. The more discretionary, the more risk — and as we noted above, even consumer staples are not perhaps the invulnerable fortress they are sometimes touted to be. We have a lot of calls on deck for the next two weeks — and we’ll let you know what we hear.

An Unrelated Observation — Are There Fewer Buyers For Longer-Dated Merchandise?

In a conference call webinar that we broadcast a few weeks ago, we encouraged investors to “stay liquid and agile.” Recent years proved to be a good period for private fund opportunities, and many performed very well for investors who got in early during a period where money was “free.” Our recent observation is that we have started to receive more solicitations for private investment, private real estate, and private equity funds. By this we mean that more private fund sponsors have been reaching out to us with offers targeted at qualified investors — including funds touting exposure to pre-IPO tech companies.

Even though we do not invest in private funds for our clients, we are being solicited. Aside from the fact that the good private funds do not solicit investors who don’t buy privates, it makes us question whether there isn’t a reduction of overall demand for these investment products. If that is the case, our advice is to stay away. As we said above, past returns of many private funds were very good, but past returns may not be very relevant in an environment where money will likely cost a lot more than it has. These are typically not liquid investments, and when you are stuck in them, “agile” is not how one would describe them.

On the subject of pre-IPO investing, we encourage investors to understand the phenomenon of the “down round” and looking for new buyers. The usual buyers are looking at the investment landscape and concluding (quite rationally) that this is not the time to be diving into investments whose fruition lies years or a decade in the future. So then they imagine that marks might be found by an appeal to “get in” before the companies go public. If anything, this is a sign that the shelf life of profitless unicorns is rapidly expiring — and if such opportunities come your way, we would advise you to be very sober about valuation.

Our Next Zoom Call

We’ll be hosting a Zoom call on May 5, following the Fed’s next meeting. We look forward to discussing all these topics in greater depth, and hope to see you there.

Thanks for listening; we welcome your calls and questions.