Although we manage investment portfolios for our clients, we also view part of our vocation as being financial educators — something which, through our writing and our media appearances, we’ve been doing for almost as long as our firm has been in existence. We believe investors have a right to real information and to disinterested analysis of that information, free as much as possible from partisan and ideological bias.

We Warned You

That goal was behind our call at the beginning of 2021 that, contrary to all the modeling and assurances of Fed and Treasury officials, and against the consensus of many analysts who took that modeling at face value, we warned you that the sea change in inflation that was underway would change everything. What factored into our analysis was our experience of previous inflationary epochs, especially in the 1970s. The post-2008 era of quantitative easing lulled a lot of monetarist inflation fears — after all, huge liquidity was created in that era without causing inflation in much but financial assets. We saw that this time would be different, thanks to the pandemic’s coordinated stimulus in which the Fed and the Treasury Department worked hand-in-glove to inject money directly into the real economy at an unprecedented rate.

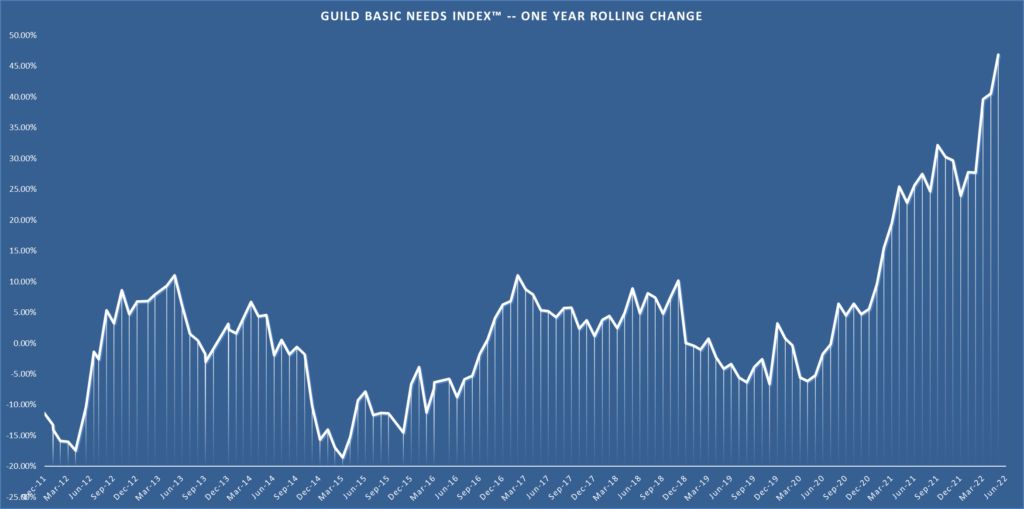

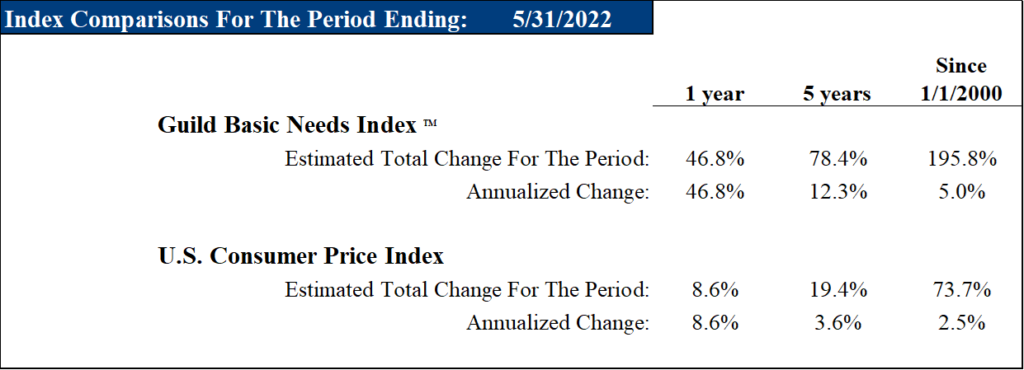

Now we really see the chickens coming home to roost. Our skepticism about the ways in which official statistics can be used to massage inflation numbers led us decades ago to construct our own inflation measure, the Guild Basic Needs Index [GBNI], which is constructed with an unvarying and unadjusted allocation to basic consumer expenses on food, clothing, transportation, and housing.

The latest for the GBNI? It is up 46.8% year over year.

What Comes Next?

Of course, the path forward from here is going to have steep inclines, falls, potholes, curves, and straightaways. We know nobody that can honestly claim they know the path forward with certainty. It is likely that if we are not already in a recession, a recession will be starting in the coming months (as former New York Fed Governor Bill Dudley said yesterday). The depth and duration remain the key question for investors – yet the Fed is still discussing the robustness of the U.S. economy. As we indicated last week, we see economic data continuing to deteriorate.

Fed Doesn’t Want Recession? We Call Foul

The Fed’s messengers work to assure to public that the Fed does not want to cause a recession; as we have also pointed out, their recession-causing track-record is nearly perfect. But the real point is that there are two components to inflation: supply and demand. The Fed is of course completely unable to do anything about supply. It can’t print oil (or gold, or bitcoin, for that matter). However, it can do something about demand– it can destroy it, by reducing liquidity in the financial system. So really, flirting with or causing recession is in fact the only way the Fed can deal with inflation, and of course, Fed officials know this very well. In his testimony to the U.S. Senate Banking Committee this week, Fed Chairman Powell admitted that his policies are directed at squashing economic demand. Doing this will cost jobs.

Receding Liquidity

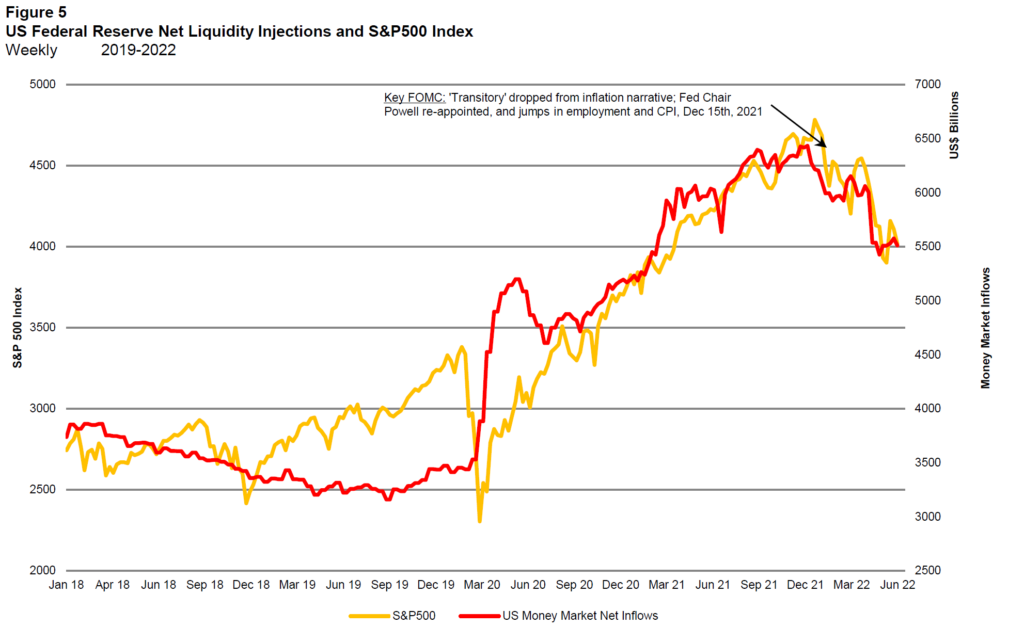

Around the world, the tide of liquidity created by pandemic is receding. Is this phenomenon correlated with stock markets at the whole-index level? Yes, it is.

Source: CrossBorder Capital

Will the Fed blink, as we discussed a few weeks ago? Yes, eventually — but it will take more than stock market volatility to make that happen. The Fed’s central concern — indeed, the main concern of central banks everywhere — is the stability of credit markets. Until credit markets begin to crack — or until unemployment and the pain of middle class voters lead politicians to really ratchet up their demands — Fed leadership has communicated its strong intention to continue the inflation fight. Between rising rates and draining liquidity, that presents a difficult prospect for equities — especially those that remain very highly valued even after the past few months of declines.

When Will the Fed Blink?

What will turn the market will be the Fed’s turn — so when is that likely to happen? The most recent Fed meeting showed the consensus among committee members for the Fed funds rate cycle high-point at 3.8%. We believe it is unlikely that the Fed will be able to get it to that level before recession, unemployment, and stressed credit markets together evoke an easing response.

But before that point is reached, while raising rates, the Fed will also be draining liquidity — as will the European Central Bank, aggressively, beginning later this summer. Other global central banks are on the same path; liquidity is also receding in China. Therefore it is likely that a tumultuous period lies ahead for the next several months, one that could see overall market levels decline still further.

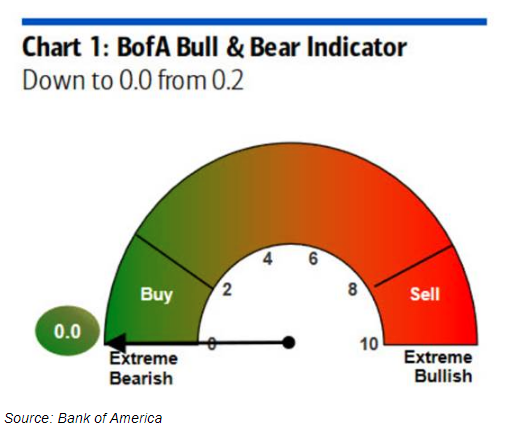

Sentiment Hits Bottom

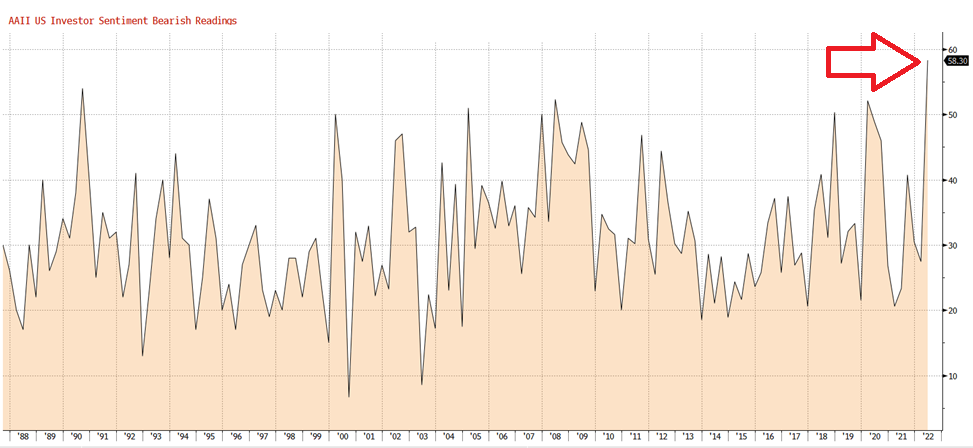

The market’s decline may have further to run, but be on the lookout for values being created. Usually when sentiment gets this bad, we have moved far beyond the early stages of the decline. Historically bearish sentiment levels are being reached according to several sentiment tracking measures.

AAII Bearish readings the highest in 35 years.

Source: Bloomberg LLP

Whenever the markets detect the Fed is blinking, you will want to own investment assets, but not everything will work.

Europe? Calling the Reward/Risk Suboptimal… Is Being Kind

We note particularly that old weaknesses are being exposed in Europe, as the spread between German and Italian bonds is once again widening drastically. A decade back, we wrote a great deal about the European debt crisis that threatened to break up the Eurozone, and in the years since, we have warned readers over and over again that the fundamental structural problems of the Eurozone have never been addressed or resolved — only papered over. The pandemic produced a lot of paper for that purpose. Now it is being withdrawn, and the bond markets are showing that Europeans believe the European Central Bank has lost control of inflation. There is no easy and apparent solution to its dilemma, short of a fiscal union that the northern Europeans will never accept.

We believe the euro is going lower against the dollar — as are the yen and the yuan. In the short term, this dollar strength will not be good for gold. In the medium and long term, the challenges to global fiat currencies will be good for gold, which we believe will continue to effectively serve its age-old role as an inflation hedge.

How Investors Can Navigate The Turmoil

The point for investors is that while this will be a challenging period, it will also lay the groundwork for big opportunities as markets gradually find a bottom. Contracting global liquidity and rising interest rates will put pressure on the P/E ratio of stocks, which for the S&P 500 as a whole could well reach 14 before a bottom is found. The problem is that earnings projections have not yet begun to price in a coming recession, during which the “E” of the P/E ratio will also fall. As those revisions begin come in, as the oncoming recession comes more clearly into view, we will likely see further volatility.

While waiting for those opportunities to develop, what’s an investor to do? Here is what we are endeavoring to do for our clients:

- Maintain a substantial cash position to maintain agility and optionality.

- Bear market rallies are often fierce, and can be used as opportunities to raise a portfolio’s cash allocation.

- Seek out the stocks of companies with high earnings yield, high earnings quality, visible growth, strong balance sheets, and good sector and industry positioning. These will not be immune to the volatility of the broad market, but have defensive characteristics. Equities are a key element of inflation defense, as demonstrated in many inflationary market epochs, from Argentina and Venezuela to Turkey and Israel.

- Pick stocks first, and indexes when necessary; the coming environment will favor differentiation between different companies and will be challenging for the broad indexes. Companies that sell or produce necessities, have strong balance sheets, low P/E ratios, and are gaining market share, should be the focus if buying stocks.

- Have a substantial allocation to commodities — especially tech-adjacent commodities and energy, although these will be volatile. Recession and geopolitics could both take commodities down; but in the medium and long term, capacity underinvestment will lead to supply constraints and support commodity prices.

- Maintain an allocation to precious metals (primarily) and to select cryptocurrencies (secondarily) for their medium- and long-term role as inflation hedges. Again, these may also be volatile in the short term.

- Watch the bond and credit markets for cracks — key signs that the Fed’s blink may be drawing closer.

Thanks for listening; we welcome your calls and questions. We’ll be hosting a Zoom call on June 30 — keep an eye out for the link, and please send us your questions ahead of time.