The U.S. is likely already in recession. The first quarter saw a real GDP decline of 1.6%; the Atlanta Fed’s GDP now tracker suggests that the second quarter may come in at a decline of 2.1%. Two consecutive quarters of decline meets the technical definition of a recession.

The question that remains is how long and how deep the recession will be. As seasoned investors know, the bear market accompanying a recession typically finds its ultimate bottom months before that recession ends, since the market is a discounting mechanism looking out 6 to 18 months into the future.

We noted how quickly market sentiment and consensus economic forecasts went south after the market’s January peak; it was, in a way, an extension of the wild gyrations in expectations that have characterized the whole period of the pandemic. We suspect that the eventual upturn from the present bear market will also be quick and surprising. Investors who are in cash at the time of the turn are likely to miss, painfully, a significant part of the initial upward move.

One thing that we have learned in our more than 50 years of investing is that panic selling is almost never a good idea — there has been only one juncture in all those decades when it was an effective course of action (the 2008 financial crisis). If you can’t control the urge to panic sell when market psychology gets epically bad, the best thing you can do is hire someone else to make the decisions for you.

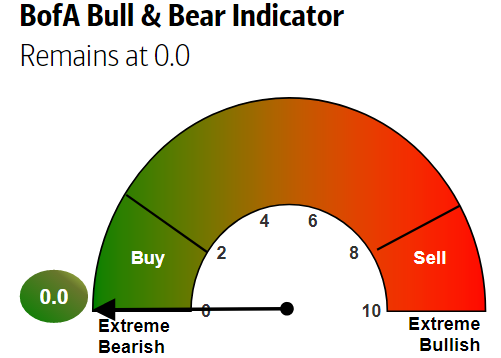

Remember — the chart below, illustrating the depth of current negative sentiment, is not a sell indication.

Source: Bank of America Research

Earnings Are Coming, And May Hurt

Earnings season will soon begin again. We suspect that second-quarter earnings will be challenging for many companies, and that forecasts will also start to rein in analysts’ expectations. Thus far, in spite of mounting recession anxiety, most analysts have not revised their forecasts down sufficiently. Companies will begin to communiucate their views about how inflation will start to affect operating margins; on a market-wide basis, that process alone could see analysts take their earnings projections for subsequent quarters down significantly. The nadir of such revisions could mark the eventual market bottom.

Inflation Will Remain High

Critically, we believe that inflation will remain elevated for an extended period of time, for a number of reasons. The most basic component of inflation is a supply/demand imbalance. In the case of many critical components of global industrial civilization, supply capacity has been constrained by long-inadequate capital investment, as well as by emergent geopolitical issues that threaten to be persistently troublesome (for example, relations between Russia and China and the developed world). Energy, food, metals, semiconductors, and real estate in many places are front and center here. These are all not luxuries, but necessities (yes, even semiconductors, for life as we know it in the developed world).

Besides inadequate investment in physical production, there are also issues with the human resources critical to increasing supply — both rising wages and the shortage of adequately trained workers. Demographics are unfavorable in many jurisdictions, and the “great resignation” prompted by the pandemic has accelerated the departure of many experienced and productive members of the workforce. The overall message is that without the removal of disincentives to capital formation and human capital development, supply constraints on many of the world’s essential commodities are likely to persist and to keep inflation elevated. This is a long-term reality that will outlast the shorter-term rise and fall of critical commodities and economic components that follows the vicissitudes of the shorter-term economic cycle.

We could call this theme “the revenge of the real.” We believe that we are entering an era in which, to a great degree and in the long term:

- Real assets will rise — energy (both new and legacy), metals, food, critical technology components, and real estate;

- Financial assets will rise if they are concretely related to real assets (i.e., the stocks of real companies managed in a rational and financially responsible manner, producing real goods and services in a desirable sector and industry, and generating real cash flows), and

- “Fantasy” assets will be challenged (stocks that depend solely on hopes and dreams, with no prospect for proximate earnings; novel and opaque financial products such as unregulated and over-leveraged crypto assets and platforms; stocks dependent on grandiose and unrealistic plans for social or environmental transformation).

Inflation, Interest Rates, and Bonds

Many stocks are falling enough for their underlying value to be attractive at the price that’s on offer. The same is beginning to be true for some bonds. Because our view of inflation is “more and longer,” this does not constitute a long-term bullish view of bonds. But it is beginning to be possible to find bonds that may offer a positive real return for a short-term holding. As recession fears continue to rise, some bonds will rally in anticipation of a Fed reversal and oncoming recession-related interest rate cuts.

The Strength of the Dollar

Another thing that might speed up the Fed pivot is the remarkable strength of the U.S. dollar during the pandemic and its aftermath, which both curtails U.S. inflation by making imports cheaper, and incrementally makes life more difficult for U.S. exporters, as their products are more expensive to foreign buyers. The chart below shows the strong dollar rally — which is, in another sense, a view of the euro and the yen, which together comprise most of the basket. The chart represents two realities: Japan’s doubling down on easing, while almost all others are tightening, and Europe’s severe mismanagement on almost every economic, financial, and geopolitical level.

In the Past 12 Months, the Dollar Index Is Up 15.7%

Source: MarketWatch

Gold FUD (Fear, Uncertainty, and Doubt)

A reader recently asked us about rumors concerning a vast gold discovery announced by the Ugandan government: could this announcement have had something to do with gold’s recent lackluster performance? Perhaps some, but likely not much; however, the incident does demonstrate some layers of the nearly infinite machinations that bedevil the gold market. It turns out that in spite of the announcement of all that unmined gold, Uganda barred exports in 2020 and has been importing gold recently.

Mr Museveni, Uganda’s president, is moving closer to Russia and China. Could the announcement be intended to help Russia by incrementally suppressing the price of gold while Russia continues to buy with its rising rubles? Is it a coincidence that Uganda is said to be granting exploration rights to a Chinese company? Whatever is happening, something doesn’t add up. All of this is par for the course for gold.

Our view remains simpler: inflation is higher for longer; gold will suffer during a period with a rising dollar; but it is an indispensable hedge against fiat mismanagement and indeed, against a potential currency crisis. Do we believe such a crisis is likely? No, it remains unlikely. But its probability, given the political and economic trends, is not zero, and looks to be rising.

Crypto Catastrophe

Defi — decentralized finance — is, in its recent incarnation, getting a comeuppance. The collapse of Celsius — brought on, most likely, by the collapse of the atrociously designed Luna protocol and its associated “unstable coin” — is dragging down other major defi operators, including some capitalized by mainstream financial firms. One researcher described a collapsed crypto hedge fund as “old-fashioned Madoff-style Ponzi scheme.”

We have said consistently that crypto investing and speculation in defi platforms and tokens should be restricted to the best operators and the most rigorous protocols — and those who have submitted themselves to the relevant financial authorities. Crypto has been a wild west, and defi in particular, a nest of old fashioned over-leverage, rehypothecation, and excessive risk of the kind that was regulated out of the stock market almost a century ago. We still find many aspects of the technology compelling, and believe that bitcoin, in particular, will maintain investor attention due to its unique characteristics and its truly decentralized nature. Crypto represents some of the best solutions to supplant the expensive and inefficient legacy global money transfer networks (such as Western Union). But for now, it will continue to behave like a very volatile tech stock.

Thanks for listening; we welcome your calls and questions. If you missed our June 30 Zoom call, you can listen to it here.