Inflation Bites

Another month, another sky-high CPI print: at 9.1%, the highest year-over-year inflation since 1981. Of course, the methodology of constructing this index has changed over the decades; if the methodology employed in 1990 were used today, the reported rate would be 17.3%, according to ShadowStats. Even this is an understatement of how inflation is being experienced by U.S. consumers. Next week when all the component data have been released, we’ll show you how the Guild Basic Needs Index [GBNI], our in-house real-world inflation gauge, has changed in the past month.

Source: Bloomberg, LLP

Last week we referred to the “revenge of the real”: the particularly intense way in which the rolling changes of the past two and half years have brought home to voters, consumers, and investors the importance of necessities. As a correlate, what has also been brought home is the silliness, or sophistry, or opportunism (depending on your perspective) of grandiose plans for the rapid reconstruction of the economy, or society, to match contemporary academic and elite conceits. The general population is beginning to realize that they can do without grandiose plans, but they can’t do without affordable food, housing, transportation, and clothing, and reliable systems to deliver those goods and services.

What People Really Need

Over the past few months, we’ve written about many elements of this equation — real goods that are the lifeblood of the real economy that delivers real goods and services to real people. That has included new energy and tech-related commodities — such as lithium, battery minerals, and rare earths — as well as agricultural commodities, semiconductors, and legacy hydrocarbon energy. But among legacy hydrocarbon products, there is a special place for natural gas.

Natural gas is perhaps the most critically important industrial feedstock. Because it is a low-carbon generating fuel relative to coal, it has become increasingly important for electricity production. It also provides heat. But beyond that, it is the ultimate source for many universally necessary components of modern economic life: plastics, many chemicals, and perhaps most of all, fertilizers. Many do not realize that in toto, the population of Planet Earth largely subsists on a diet of natural gas, converted into fertilizer and thence into edible crops and animal products via the Haber-Bosch process. Without natural gas and the fertilizer made with it, millions would starve. This is the “revenge of reality” in spades.

Natural gas has faced the same fate in recent years as many legacy hydrocarbons: insufficient capital investment. In the United States, blessed with abundant natural gas made available to consumers by technical innovation in lateral drilling and fracking, this was less true during the years in which new extraction technologies led the country into energy independence for the first time since the early 1970s. Political forces pressing for a rapid transition to renewable energy sources, though, have become a weight on the industry; regulatory uncertainty is one thing that’s certain to make companies hesitate to put cash to work in capacity expansion. This was even more true in Europe, where such views have been prevalent for longer and have resulted in a much more perilous situation.

Reason Dawns

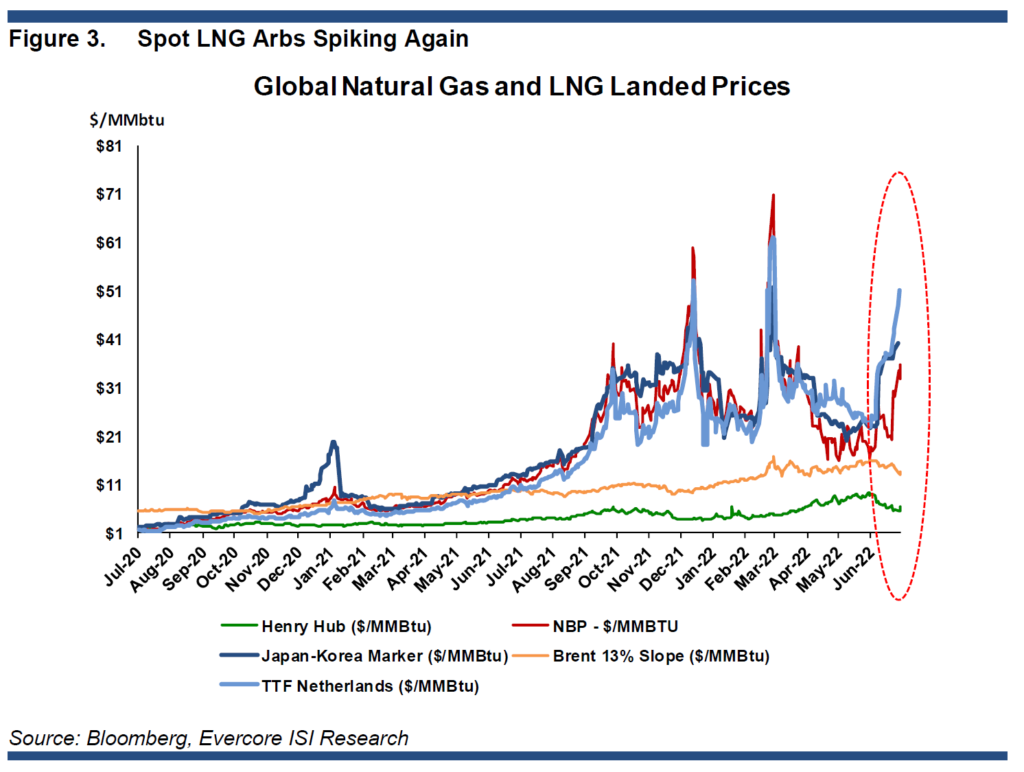

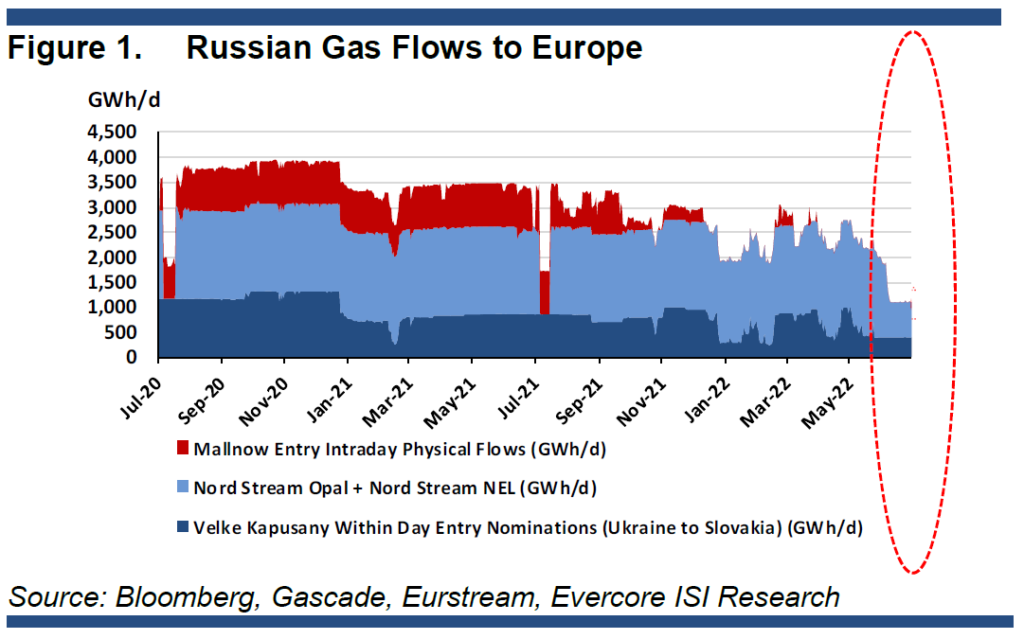

Reason has begun to dawn in Europe — driven by unfolding events in Ukraine. Europe’s ideological adherence to an extreme green agenda meant that it increased its dependence on natural gas — and that meant its dependence on Russia, which supplied, until very recently, 40% of the continent’s needs. Without Russian gas, the German economy — the closest thing Europe still has to an engine of productivity — would experience a catastrophic contraction. And European gas prices have already been accelerating dramatically.

Source: Evercore ISI

As the English wit Samuel Johnson said, “When a man knows he is to be hanged, it concentrates his mind wonderfully.” That concentration has just begun to creep into the minds of Europe’s lawmakers, as they contemplate the prospect of a Russian gas embargo. All of a sudden, natural gas has been anointed as an environmentally friendly fuel. All well and good, but this does nothing to deal with the current impasse, which was many years in the making, as we have pointed out to you often. Indeed, the engineering of European dependence on Russian energy has been so long-lasting and so consistent that it’s difficult not to speculate that it was intentional.

Shrinking Russian gas supplies to Europe — down 60% since mid-June, likely a Russian response to European sanctions — were already causing jitters.

Source: Evercore ISI

Anxiety really got elevated when Russia shut down the critical Nord Stream pipeline for scheduled maintenance on July 11. Initially this was because a critical turbine sent to Canada for repairs could not be returned due to sanctions. A special waiver from Canada solved that problem, to the market’s relief. But the question remains whether the flow of gas will resume on July 23. The anxiety may continue into August, since the delay may create technical logistical problems in integrating the turbine back into the pipline.

Severe and longer-lasting gas flow disruptions to Europe could well tip the continent deeper into recession (like the U.S., if it is not already in a technical recession, it will be soon). A full cutoff would likely cause a German GDP contraction of 5% or more. Europe has been filling its winter reserves, but is off its target and unlikely to reach it. Modelling suggests that a European recession triggered by such an energy shock would be deeper and more severe than one driven by more garden-variety cycle causes (such as tightening financial conditions).

The “silver lining,” if we can call it such, is that such an event would certainly spell the revision of financial tightening plans. As it is, the U.S. inflation data were so hot that the prospect of a 100-basis-point rise this month is now being priced in at a more-than-50% probability by markets.

Commodities: The Long View

Commodities are notoriously difficult to trade because of the multitude of complex cross-currents that affect spot prices. Current events in Europe are a splendid illustration. Very large contrary forces are bearing down: which will prevail and what will the outcome be? Will Russian intransigence power new spike highs? Or will the prospect of a German-sparked recession cause further retreat in the recession-sensitive commodities?

We do not know, but in the longer view, the story seems clearer to us. For a significant period, much of the world’s political leadership has failed to recognize the reality that their policies were setting up a long-term constriction in the supply of commodities that are essential for the functioning of the real economy that feeds, warms, and powers everyday life. Even as current events begin to shift that unrealistic and destructive psychology, a structural, long-term demand/supply imbalance is likely to persist.

Another separate, but related factor in Europe has been an utter lack of realism in dealing with Russia — either appreciating Russia’s concerns as a great power, or evaluating the threat posed by Russia’s ambitions in its near abroad, or planning for a realistic easing of European dependence on Russian energy so as to free Europe for effective responses to Russian aggression. As a consequence, Europe and the United States may be setting up a long and costly “frozen conflict” in Ukraine which may persist for a long period of time — exacerbating the effect of sanctions on global energy prices and through them, of global inflation. Unfortunately, the western nations have not provided themselves any avenue to exit sanctions without a total loss of face, having more or less declared that a negotiated settlement in Ukraine is anathema. A healthy dose of realpolitik would help, but it is not likely to be forthcoming.

Thus, in the longer term, even as recession fears rise and spot commodity prices suffer, we view commodities as essential hedges against a “higher for longer” inflationary world, and essential beneficiaries of an age in which scarcer capital and a new policy realism bring real necessities back into prominence. We also believe that a shift in the emphasis of portfolio construction towards what is real and what is necessary will be a good filter for years to come.

Please note that we do not mean “buy commodities now.” We noted above how difficult trading commodities can be, and the world’s precarious situation as it teeters on the edge of recession is a perfect illustration; going all-in on commodities at this point would be foolhardy. At some point and in the long run, many commodities will be attractive because of the secular supply shortfall caused by foolish and short-sighted policy. In the near term, recession would cause commodities to dip, particularly if we end up experiencing a double-dip recession (a technical recession, followed by easier monetary policy and more inflation, followed by another recession — similar to the 1980s). Many commodities, for example base metals, would be a buy at a bottom during that second recession. Be careful and patient with commodities, and recognize the fluctuations that can happen. Gradual accumulation of gold can make sense at current levels.

Thanks for listening; we welcome your calls and questions. If you missed our June 30 Zoom call, you can listen to it here.