Our editor, Rudi von Abele, is taking a much-deserved week off. We apologize in advance that instead of polished, well written research analysis, this week you will get the musings of a portfolio manager. Do not despair, Rudi will return next week, and we will all be more intelligent for it.

In over 32 years of working with Monty, looking at global markets, constructing portfolios, navigating global markets, and listening to clients’ concerns, I posit that we have a tendency to think for ourselves, and do not reply on commonly dispensed Wall Street guidance in making portfolio management decisions. We want to be more flexible and able to target specific opportunities. We also want to avoid anything that looks unattractive. No model or asset allocation mandate is telling us we that need to be broadly diversified… or must hold a certain percentage in bonds, even if they offer poor reward/risk. We want to be selective and agile.

In this letter we will take a trip around the investable world, sharing some general observations as to where we might want to focus our search during the rest of 2022 and into 2023.

In the northern hemisphere, the summer months bring more holiday and destination travel. For many summer travelers, work gets pushed aside as they vacation around the planet for short visits and longer stays. After summer months end and people finish their holiday travel, it seems as if capital starts to travel. Investors, asset allocators, and companies get back to focusing on work: reassessing, moving money and resources around, getting positioned for the opportunities (and risks) that they see in the rest of the year. September and the first half of October can be more uncomfortable and volatile for investment markets, and as we look at September ‘22, we see plenty of issues around the globe that could make investing challenging.

September/October selloffs often make decent rallies. Our clients’ portfolios have cash balances to take advantage of the dips — when the “good” gets taken down with the “bad.” As we look at the rest of 2022 for opportunities, we believe the volatility will create some good ones.

Traveling the Globe — What Could Become Attractive?

So let’s start this trip around the world markets — looking at the reward/risk setup for various regions and trying to identify where capital could flock (or flee). Our whirlwind tour will go from east to west, offering a brief macro view as opposed to a detailed analysis. There are things we can discern from a high altitude that dictate whether we want to do more on-the-ground, bottom-up analysis in order to find attractive investments. Conversely, there will also be some areas where we can see from the air that the situation on the ground looks too challenged to even land.

China

It appears that President Xi Jinping wants to solidify the Chinese Communist Party’s power rather than ensure the continuation of the rapid economic growth and expansion of prosperity China enjoyed for over 30 years.

The economy is too large to grow at the high single digit/low double digit percentage growth rates that it enjoyed for many years. That fast growth created a lot of corruption and resulted in unbalanced and unstable markets… and a banking system that even though it is controlled by powerful forces in Beijing, it is weaker than its size would suggest.

China still maintains manufacturing prowess in many areas, but it now it has real competition from countries that offer more transparency, lower costs, and less draconian health directives from Beijing. China’s highly leveraged property sector is in the middle of a mortgage loan crisis that is undermining confidence and could metastasize through to other industries.

Also, there is the aggressiveness towards Taiwan that has to be considered. What is Xi’s plan? How long is it before China gets really belligerent towards what they call “theirs”? Xi has some political maneuvering to do between now and the Communist Party Congress in October. Perhaps that will shine more light on Beijing’s priorities… and their timing. Xi is interested in expanding his control in China so that he can be dictator for life. Wise observers think the yuan could have a major decline in value, and the banking system needs a bail out in the next year or two.

The Shanghai Composite Index trades at about 13x 2022 earnings and analysts only see profit growth of 5-10%… denominated in yuan

In general, China no longer looks like a favored destination for longer term investment, but it might be a market that one wanted to trade for the shorter term… if you get a significant devaluation of the currency inspired rally.

Asia, ex-China

Other Asian economies and markets tend to be more affected by China’s economic performance. Trends in energy prices also tend to have a larger impact on Asian economies. Even though there are unique elements in each Asian market that make them more or less attractive, the one most important consideration is the U.S. dollar. If a few things fall into place and the dollar turns lower, some Asian markets will definitely be worth looking at. The asset class often referred to as “emerging markets” includes a lot of more advanced and developed economies that have moved beyond the emerging phase. The asset class looks cheap on a price-to-earnings basis, and inflation is helping boost some of their nominal numbers… in local currencies. Remember, as we have said many times over the years: earnings growth in local currencies is good, but if their earnings are not growing faster in U.S. dollar terms than profits are growing here in the U.S., then it is hard for U.S.-based investors to see much benefit.

Interestingly, Bank of America Merrill Lynch recently published their “Trade of 2023.” It is “short U.S. dollar, long Emerging Markets”. For this trade to work, they suggest that a U.S. recession could result in a weakening U.S. dollar. China could trough and maybe even further devalue the yuan. If this happens, they like EM. The asset class “EM” usually contains China, Korea, Taiwan, India, Indonesia, Hong Kong, Brazil, and others. We would want to be selective, or perhaps just remove the China allocation. There is an emerging market ETF without China that trades under the symbol XCEM. While it is a little heavy on Taiwan at 26%, looking into its constituents we see that when you remove China… EM can get quite cheap, as the average P/E in XCEM about 9.

Perhaps there might something to this “EM” trade if the global economy doesn’t weaken too much and the U.S. dollar stops its ascent. Recognize that the trend is with the dollar to continue to move higher, and there are enough factors keeping that trend in place.

Australia and New Zealand

We do not find them particularly cheap, nor are they particularly expensive at about 13x earnings. These markets will probably go up and down based on expectations about economic fortunes in Asia and the shifting capital flows that inspires. It is hard to point to any real catalyst (other than perhaps spiking commodity prices) that will cause a lot of new money to flow into Oceania. The political situation is stable, but not necessarily friendly to large amounts of foreign capital. New business startups are few and their market tends to react to Asian (Chinese) economic demand for its resources more than its own dynamism. Commodities alone are not enough to make them attractive with the specter of slowing growth… or recession looming.

India

We have thought for years that India is a market and an economy with tremendous promise longer term. The key is buying it right, as it always seems to be expensive on a relative valuation basis. Currently, the Indian market P/E is over 22x earnings. This valuation premium has a lot to do with the fact that the country has strong demographic trends in place and a large aspirational, educated population… and the view that government policies generally seem supportive of increasing prosperity.

At present, the country is benefitting from being able to buy Russian energy at below market prices, but this may not last. When energy prices are high, India runs into fiscal difficulties and the rupee tends to suffer.

India is a watch for an opportunity to buy the next selloff. As with other foreign markets, the U.S. dollar / Indian Rupee exchange rate will have a lot to say about its attractiveness.

Russia

Uninvestable — although we have to admit that Moscow’s adroit management through sanctions has been a strength.

Middle East

Since so much of the Middle East’s economic attractiveness is tied to fortunes surrounding fossil fuel prices, and because we can find better energy investments in other areas… our view is that the region’s relative lack of transparency makes investing in their companies less compelling. Outside investors wield almost no power in the boardrooms of companies in this part of the world.

Africa

On a relative basis, African equity markets are still quite thin. If the U.S. dollar weakens, there could be a lot of upside in some of these markets as an economic transformation is rapidly reshaping several nations’ economies. Financial services are expanding rapidly, communication technologies have improved, and this has seen a lot of money from China and elsewhere start to unlock some potential; however, it is also unlocking more corruption. When investing in a company, and doing research on companies, you want to have confidence that your interests as an investors are aligned with the motivations and interests of the managers of the company… and the government. This challenge is not unique to Africa. It can be difficult to research the intentions of managers anywhere.

There is no doubt that Africa is an exciting destination, and a continent rich with natural resources. How those riches accrete to foreign investors in a fair way is where we have more doubts.

Europe

“A Giant Open-Air Museum” was how Byron Wien and Barton Biggs referred to Europe in the late 1990s. Nearly 25 years later, it seems little has changed.

Europe is struggling for relevancy on the world stage politically and economically. Despite a large population, decades of regulatory burdens and bad policies have served to weaken the economic dynamism of the continent. While it may be beautiful, rich with history and culture, and a lovely place to visit… declining productivity, declining competitiveness and declining investment have made the innovative and industrious look elsewhere to build their businesses. Large corporations (who are tight with the big banks and with the government) can better navigate and even influence the heavy regulatory environment. Entrepreneurs and global investment capital allocators know this, and usually look elsewhere. It does not have to be this way, but until the people of Europe demand better policies from their leadership, it makes it hard to get excited as an outside investor.

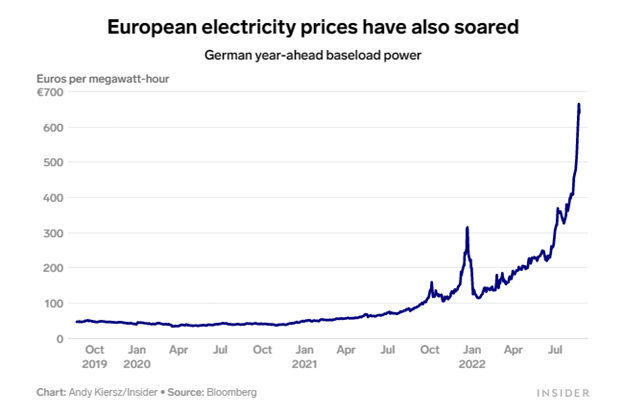

Europe’s current energy crisis is 100% the fault of bad policies. So now, the officials across the continent are planning to take “urgent steps to push down soaring power prices,” Commission President Ursula von der Leyen said on Monday. “Urgent steps?” Sounds to many observers like more bad policies are coming. Efforts at fixing the issue seem less important than deflecting responsibility. Von der Leyen added that “The skyrocketing electricity prices are now exposing, for different reasons, the limitations of our current electricity market design.”

The continent seems destined to endure a major economic disruption this winter unless something changes rapidly. Because of these headwinds, investors looking for any opportunity in Europe would be better served focusing on the continent’s large corporations serving customers across the globe. All that being said, sentiment sits near all time lows, expectations are so low it could provide a contrarian trade opportunity… if the worst case scenarios do not play out. Just looking at the numbers, we see some attractive dividends (4% to 5% are common), and a relative valuation of under 12x earnings, so perhaps there is some reason to investigate and take a closer look. The Euro breaking under $1 will provide some support to the European multinationals, but the direction of the euro is warranted. Things do look quite rough. Europe has a whole host of problems that make it hard to own, but it is cheap.

South America

Chile had been considered the best managed South American economy. The country was benefitted by natural resources, and for decades had policies that allowed global access to those resources. The new leadership in Chile presents some new challenges for international investors in Chile to consider. Will companies operating there have to renegotiate terms with this new government? It is not just Chile where this is an issue. Argentina, Colombia, and Peru have all seen more left-leaning politicians take control of the governments. Traditionally, this has not been considered a positive for stocks.

Brazil has elections later this year. Like the EM comments above, Brazil could provide a good opportunity in the future… if the Brazilian Real were to strengthen vs the dollar. The food commodity, energy, and mineral riches of Brazil are complemented by corporations with management that is talented enough to navigate a volatile currency and inflationary environment. Valuations are some of the cheapest out there with the average P/E ratio in the Brazilian ETF EWZ being close to 7 (largely due to the low valuations afforded to commodity related business). We are watching Brazil’s Presidential elections later this year. Perhaps that could provide an impetus to start looking for ideas there.

North America

U.S. Equities

Since Jerome Powell’s short and to-the-point speech in Jackson Hole last week, the prevailing mantra is “Don’t fight the Fed.” The interest rate hiking cycle and an expansion of the Fed balance sheet runoff is not ending soon. The market is digesting this reality as it heads into September, which is traditionally considered the worst month of the year for stocks. After getting overbought in the July/August bounce (from what was a very oversold condition in June), the market needs to assess what the Fed actions and the resulting U.S. dollar strength are going to do to earnings.

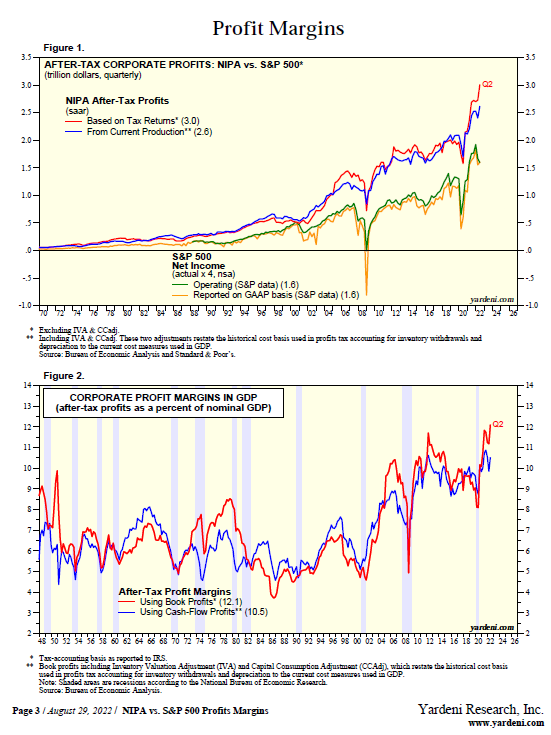

The ability to turn economic activity into profits is what American companies do very well relative to the rest of the world. A couple of charts from Yardeni research illustrate that profits and profit margins remain at record highs. The first chart is in nominal dollars, so of course it is record levels, but looking at the second chart shows how far margins have stretched. The impacts of a higher cost of money, higher input costs, and the strong U.S. dollar… are the questions investors need to figure out.

With U.S. profitability the envy of the world, it is no surprise that the U.S. market sells at a higher valuation. As of today, the U.S. S&P 500 earnings estimates for 2022 and 2023 are about $228 and $246 respectively. These numbers have been drifting lower in recent months as the macro picture and inflation picture undermines the business of so many industries. So, an S&P 500 Index at 4,000 makes it about 17.5x current year earnings… and 16.2x 2023 estimated earnings. Not outrageously expensive, but definitely we would not consider it cheap.

Within the U.S. market we are focusing on areas with more visible and robust earnings growth in energy, innovative technology, healthcare, and commodities. In the coming weeks and months, due to poor seasonals, we expect these better areas can be taken down in an overall market decline. We plan to use the next big selloff to take advantage of the lower prices in these attractive areas. The U.S. remains the most visible market for long term investment… in spite of how the politics and media want to paint things.

Canada

Canada is very well positioned with respect to natural resource wealth and its proximity to U.S. markets which receive over 75% of its exports. There are many well run businesses, the rule of law is sound, the credit rating is among the best on the planet, and the currency is stable, although it will get whipped around by commodity markets. After natural resources, banking is the largest sector in the economy, so the valuation of the Canadian stock market at about 13x earnings sounds cheaper than the U.S., but it lacks the diversity, depth, growth-orientation found in the US market.

Mexico

Mexico should be more attractive than other Latin American countries given its proximity to the U.S. economy’s strength, but it is hard to find good, well managed companies at attractive valuations. There are successful businesses operating in Mexico, but many are divisions of international companies that operate in Mexico. Also, similar to what was said earlier about Argentina, Colombia, and Peru, the countries with left leaning governments tend to reduce the potential upside of those countries’ stock markets.

It Is Not Just About Geography

On this “trip” around the globe we focused on world equity markets; next week we will do a similar overview of the relative attractiveness of various asset classes. However, we will tease you with a couple particular situations that bear discussing further. One is doing well (uranium), and the other is not (gold).

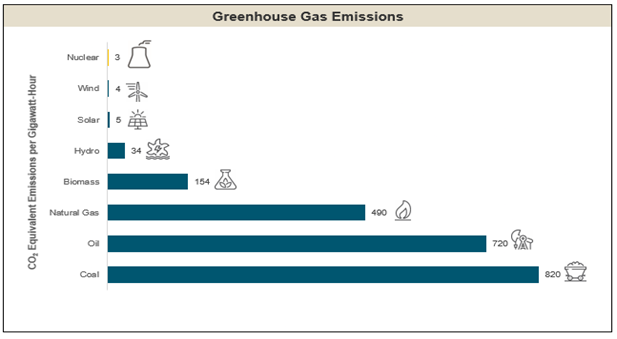

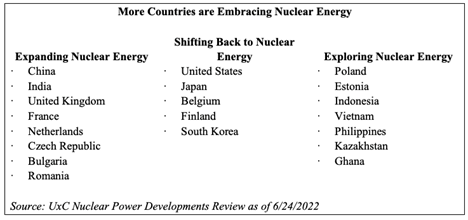

Necessity is Driving Interest in Uranium

People’s fear still clouds clarity with respect to nuclear energy. However, we believe it is only a matter of time before nuclear energy is embraced as the most likely solution to solving the carbon-related problems. CO2 problems (both real and imagined) are driving people and policy makers to do maddening things. Uranium provides some answers.

The Strong Dollar Is Taking Any Shine Off of Gold

Gold has reasons to be attractive, but it can’t get out of its own way. It is an interesting setup for precious metals, but only if the dollar starts to weaken. What few bullish data points frequently seem to be consistently ignored by capital allocators around the world. China just imported $108.8 million worth of Russian gold in July — an increase of 750% from June, and 48 times what it bought in July 2021. What does it mean? The market doesn’t know. Inflation is running at 1970s levels, yet gold is not behaving as the inflation hedge that people have expected.

It is not just gold that the strong U.S. dollar is impacting, as discussed in several sections above. IF the dollar were to turn lower, then the opportunities for gains in international and commodity markets improves dramatically.

Thanks for listening, and stay tuned for more thoughts on where we see places to make money.