After our review of the great bull/bear debate, and last week’s rundown of global stocks, we thought it would be useful this week to zoom out even further to the asset class level. We’ll briefly examine where various asset classes stand in the context of current global developments; what sort of future investors and speculators are currently anticipating; and what we’ll be looking for as we decide on asset-class allocations in the latter half of 2022 and the beginning of 2023.

First, a brief recap: our readers are likely aware that asset classes are the broadest groups of assets through which investors may hold their weath. Since wealth is not abstract, an asset-class allocation is the most fundamental decision an investor can make: you have wealth, so what kind of vehicles will you use to hold it?

The history of economies and financial markets consists on a basic level of the origination of new asset classes, dependent on social organization, law, commerce, and technology. Every few centuries, a new asset class will appear. Precious metals and agricultural commodities (especially cattle) have served as stores of wealth since before recorded history. Property rights in land (with reliable and enforceable title) emerged with the first states, as did currencies. Eventually, marketable debt and equity securities emerged, and then derivative contracts and exchanges on which they could be traded; the industrial revolution brought energy commodities to prominence. Most recently, we’ve seen the emergence of cryptocurrencies and other digital assets. The future may see the emergence of arguably new asset classes, such as virtual assets in the metaverse. (Asset classes can also disappear, thankfully; human slaves were, for thousands of years, a very significant store of wealth.)

Even though technology, law, and complex markets have made exchanging and holding assets simpler and smoother, investors still largely have the same perennial set of asset classes available to them:

The annual performance of different asset classes is often summarized as an “asset class quilt,” from investors can get a view of the comparative performance of different asset classes over a period of years. In the sample quilt below, note that some asset classes are divided into groups (e.g., debt securities are differentiated as government bonds, investment-grade bonds, and high-yield bonds; equities are divided into U.S., developed-world, and emerging market stocks).

An Asset Class Quilt For the Past Ten Years

Source: Bank of America Global Research

One thing that must strike any observer is that relative asset class performance is highly volatile, and highly responsive to changing global technological, geopolitical, regulatory, financial, and monetary events and trends. This is one reason why the most common asset-class allocation — a portfolio consisting of 60% equities and 40% bonds — is being called into question. The vast majority of normal investors have been corralled into an inflexible 60/40 portfolio over the past few decades — and changes are now afoot that may make it a case study in why “past performance is not an indicator of future results,” and why active adaptation to changing conditions is probably the more appropriate strategy for an environment in which old axioms, correlations, and relationships are shifting or breaking.

Here are some asset-class level thoughts about the current situation, the near-term outlook, and the longer-term prognosis.

Cash

There’s too much to be said here briefly — and too much divergence among different currencies — but cash is the only asset class directly benefitted by a period of rising interest rates (to the extent that your income yield is also rising) such as the one we are now experiencing. For most other asset classes, rising rates are a headwind.

Bonds

As our readers will remember, the value of a bond moves inversely to its yield, and the longer-dated the bond is, the more sharply the value moves with a given move in yield. Paul Volcker took the Fed funds rate to nearly 20% in early 1981 to combat the last episode of persistent inflation in the U.S., and the decades between then and now saw a generational decline in interest rates — a never-ending waterfall to the “lower bound.” That led to bonds enjoying a generational bull market… after bond investors had to endure a horrendous decade in the 1970s.

Thus far this year, rising interest rates have punished bonds across the board. The market had hopefully — and short-sightedly — started pencilling in a Fed pivot to easier policies sooner rather than later, and Chair Powell threw cold water on that prospect at Jackson Hole. Fed determination to restrain inflation is stiffer than the market had given credit for. With that said, however, there is an elephant in the room: Europe.

The stunning strategic idiocy (there is no other adequate word) of Europe’s ruling elite staggers the mind: they have left their countries dependent on a hostile power for the lifeblood of their economy; worsened their dependence by phasing out reliable domestic sources of energy in obeisance to ideological conceits; and are now flailing to convince their irate and frightened citizens that they will be able to handle the situation with monetary legerdemain and price-setting diktats, even as “winter is coming.” All of this is occurring on a continent where there were already deep pre-existing financial problems deriving from the half-baked nature of the euroand the failure of the bloc’s financial authorities to deal with the fallout of the last crisis a decade ago by recapitalizing their banks. The short summary is that Europe is facing a real crisis and a real potential collapse into severe recession and financial instability. When this occurs — perhaps early next year — U.S. financial authorities will have little choice but to get back on the easing train in order to contain the fallout.

Stocks

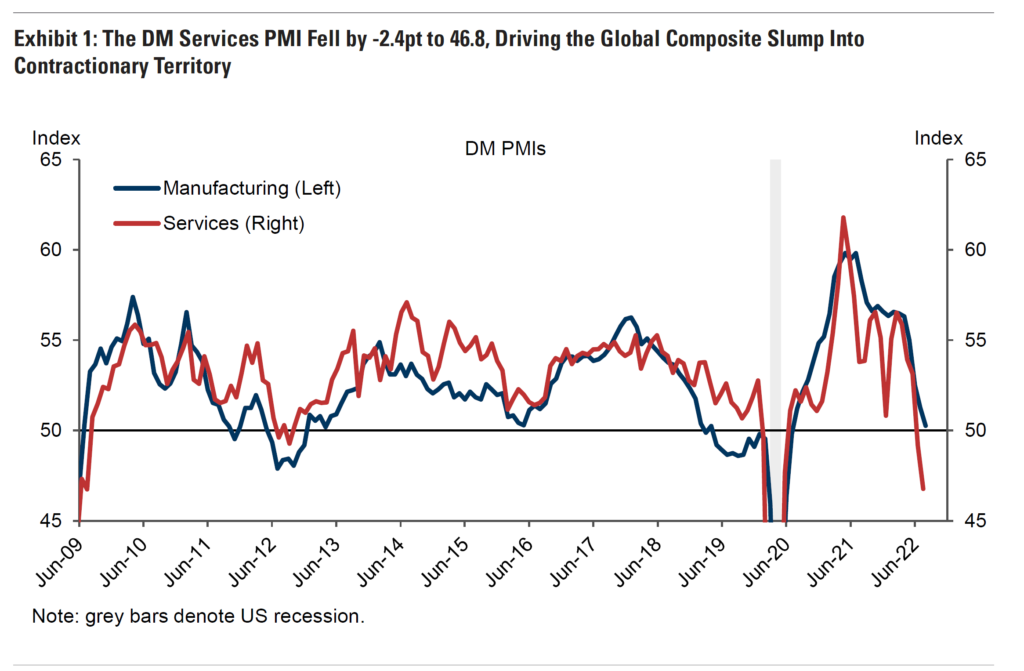

We would refer readers to our commentary last week on the situation of global equities in different regions. A brief summary might be that we still see the best opportunities in the United States, but that U.S. stock valuations, even after this year’s compression of price-to-earnings ratios, are too high — because earnings revisions that would reflect a global economic slowdown have not yet started to appear in earnest. Developed markets manufacturing and services purchasing managers indices (PMIs) — surveys of management sentiment — are dropping sharply into recessionary territory.

Source: Goldman Sachs Research

Real Estate

A few simple cautions apply here. First, investors in REITs should be cognizant that they are investing in leveraged financial entities and not directly in the underlying assets. We are entering a period in which leverage will be challenged. Second, in direct real estate buying, the market is deeply fragmented, with a wide spectrum of assets very different from one another in cash flow generation, likely appreciation and depreciation under different economic scenarios, location and local laws, market perception of demand trajectory, and so on. Farmland, multifamily housing, malls, warehouses, and offices are so different as to stretch the definition of a single asset class. Nevertheless, real estate is indeed “real” and can’t be printed, and has (for now) considerable tax advantages, although governments likely view it as a prime source of revenue. Despite its complexities it deserves consideration as an element of your portfolio.

Precious Metals

The dollar has again touched new recent highs against its basket of other global currencies and seems set to strengthen further. Largely this is due to ongoing global anxiety about Europe and about a potential impending global recession; in times of fear and uncertainty, the world runs to the dollar. A strong dollar is not a recipe for strong performance from gold.

Source: Bloomberg, LLP

As we noted last week, if the dollar broke, that would be a good sign for gold. Yes, pandemic monetary policy in the United States was explosively expansionary; but so was it everywhere else, and the dollar is still “the cleanest dirty shirt in the laundry.” Until some external event unfolds to force the Fed’s hand — which we noted above might be a European crisis, but could also be a China-related crisis or a Middle Eastern crisis — gold is likely to continue to lag. With that said, we note the drubbing delivered to a traditional 60/40 stock and bond portfolio this year, and in the long run, when we look at the determined debasement of the monetary unit occurring in countries worldwide, we believe that at this time gold deserves a reasonably small portfolio allocation.

Energy Commodities

Energy provides a shining example of the tug of war between short and long term processes. In the short run, when recession arrives with more bite, energy will suffer. In the long run, we believe that an immoderate attachment to impractical energy policy over the past decades — more in Europe, but also in the United States — has set the world up to be in a structural deficit of reliable energy. We also think that the conceits of ESG investing will be challenged as it becomes more and more apparent that ESG has largely served to benefit fund managers, has had little if any discernable positive impact, and has essentially corralled investors into underperforming investment strategies. If and as that reaction to the ESG push unfolds, energy equities that suffered from poor investment sentiment may experience a recovery — at the same time that they remain strong income generators due to reliable cash-flow and their critical role in maintaining economic growth and vitality. We also believe that nuclear power will play an essential role moving forward, as it is the only non-carbon energy source capable of providing reliable base-load generation capacity. We are long-term bulls on uranium.

Agricultural Commodities

Some of the same comments made about about energy apply to agricultural commodities, to a lesser degree. We have referred often this year to the “revenge of the real” — the rising appreciation of hard assets against financial assets, of things that must be grown, mined, or built against things that can be conjured into existence with a keyboard stroke. Agricultural commodities are a case in point; investors should not forget that whatever is said about carbon energy is true also for fertilizer, which is largely derived from extracted hydrocarbons. Here as elsewhere we suggest that investors look for scarcity and lean into it. With respect to food commodities, large price moves could appear quickly in either direction, but it looks like there is more of a floor than a ceiling with this asset.

Cryptocurrencies

Certainly, in the past few years, crypto has stolen some of gold’s thunder. But 2022 has shown very clearly that whatever the long-term trajectory is for cryptos — and it is far from certain how financial and monetary authorities will ultimately view and regulate them — for now, they trade like volatile risk assets. In the current environment, the outlook for such speculative assets is weak. In the long run, we believe bitcoin will have a lasting place in the global monetary ecosystem; but it is not so much a hedge against inflation as against hyperinflation. That is an eventuality with a non-zero probability — but not in our view a probability that warrants a large part of investors’ mental energy. In brief, bitcoin is worth a reasonably small allocation, as the “digital gold” we believe it is likely to become.

Other digital assets are interesting, but are basically just even more speculative examples of evolving financial technology. Our recent monitoring of the digital asset space gives us the sense that digital assets are in essence beginning to replicate the legacy financial system digitally — and we believe they will be regulated accordingly. It makes more sense to think of digital assets broadly as fintech equities rather than as commodities — and the upcoming Ethereum merge, which will see the network move from proof of work to proof of stake and begin generating a predictable yield, adds weight to this view. Again, in a tight monetary environment, such speculative assets are not likely to perform well. Hold and accumulate if you have a constructive long-term view.

A Final Note

The general sentiment of investors has become so bearish that we can’t fail to sound a word of warning. Jumping in at the peak of a rally is foolish, but going deeply short at the nadir of a decline is exactly as foolish. When sentiment goes from apocalyptically bad to merely bad, big up moves can occur, so question your bearishness as much as you are wont to question others’ bullishness. After all, all the risks we discussed above are known to all, and at the moment, short is a crowded trade. The very depth of negative sentiment takes away some of the shorts’ upside. In general, we warn against being positioned too bearishly. Even Europe, as bad as things appear to be, can experience a big rally.

Thanks for listening, and stay tuned for more thoughts on where we see places to make money.